Key Takeaways:

• Current total professional sport seating capacity in Las Vegas is 285,173.

• There are 39 signicant annual sporting events or tournaments planned in Las Vegas

through 2024.

1

• The ratio of sports and recreation instruction employment in Las Vegas to total employment

is lower compared to the rest of the country, suggesting unfullled demand.

• CBER estimates that sporting events in Las Vegas generated $1.845 billion in direct output

from out-of-town visitors in scal year 2022.

• We share three case studies on how the expansion of sports in Las Vegas has positively

impacted marketing, golf, and youth female sporting activities.

• CBER conservatively forecasts that performing arts, spectator sports, and related industries

employment will grow by 12.4 percent or 2,944 permanent jobs from 2022 to 2030.

A Summary of the Sports Economy in Las Vegas

May 2023

Authors:

Andrew Woods, Director, UNLV Center for Business and Economic Research

Dr. Nancy Lough, Director of Education, UNLV Sports Innovation

Dr. Stephen M. Miller, Research Director, UNLV Center for Business and Economic Research

Dr. John Mercer, Director of Research, UNLV Sports Innovation

Jinju Lee, Deputy Research Director, UNLV Center for Business and Economic Research

Coby Carner, Graduate Research Assistant, UNLV Sports Innovation

Zachary Allen, Graduate Assistant, UNLV Center for Business and Economic Research

White Paper

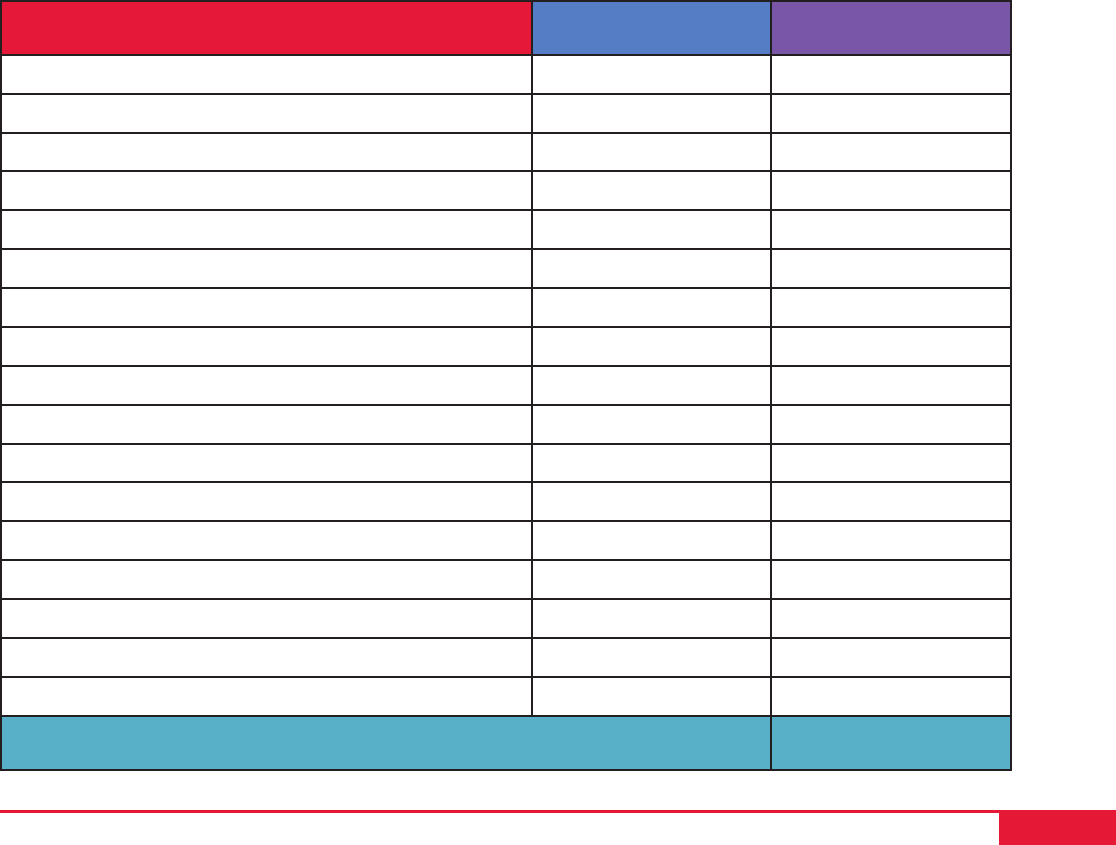

Facility Year Opened Typical Capacity

Las Vegas Motor Speedway (LVMS) Superspeedway 1996 72,000

Allegiant Stadium 2020 65,000

The Strip at LVMS 2000 22,000

T-Mobile Arena 2016 20,000

Thomas & Mack Center 1983 18,000

MGM Grand Garden Aren 1993 16,000

Michelob Ultra Arena 1998 12,000

Las Vegas Ballpark 2019 10,000

Orleans Arena 2003 9,500

Cashman Field 1983 9,334

Dirt Track at LVMS 1996 8,200

Dollar Loan Center 2022 5,567

Bullring at LVMS 1985 5,400

South Point Arena & Equestrian Center 2006 4,600

Cox Pavilion 2001 3,372

CORE Arena at The Plaza 2018 3,000

City National Arena 2017 1,200

Total Seating Capacity 285,173

Source: Las Vegas Convention and Visitors Authority; Wikipedia; The Southern Nevada Sports & Entertainment Outlook (Applied Analysis, 2018)

I. The Las Vegas Sports Economy Today

The metropolitan area of Las Vegas, Nevada is home to more than 2.3 million people and

attracts more than 40 million visitors annually. A top travel and leisure destination that

accounts for half of the world’s ten largest hotels and boasts more guest accommodations

than any other U.S. city.

2

Despite its international acclaim as a tourist destination, until

recently Las Vegas went without a professional sports team. In the last decade, Las Vegas

welcomed and became the home to three major league sports teams―Las Vegas Raiders

(NFL), Vegas Golden Knights (NHL), and Las Vegas Aces (WNBA)―and six minor league

sports teams―Las Vegas Aviators (MiLB), Las Vegas Lights FC (USL), Henderson Silver

Knights (AHL), Las Vegas Desert Dogs (NLL), Ignite (NBA G-League), and Vegas Knight Hawks

(IFL), and a major sport organization, The Ultimate Fighting Champion. Moreover, the city has

added four large sports venues (Allegiant Stadium, Las Vegas Ballpark, T-Mobile Arena, and

The Dollar Loan Center) in less than six years.

Page 2

A Summary of the Sports Economy in Las Vegas

2 Gilbert, 2023.

Figure 1. Existing Main Sporting Facilities in Las Vegas as of April 23, 2023

The largest addition to the Las Vegas sports economy was the completion of Allegiant

Stadium in July 2020 with a seating capacity of 65,000, costing $1.9 billion (Figure 1).

3

To

date, it is the second most expensive NFL stadium built in the United States. Its completion

brought the first professional National Football League (NFL) team to the local economy,

the Las Vegas Raiders. The Raiders’ relocation to Las Vegas has made it the ninth most

valuable NFL franchise in 2022 with the highest ticket revenue of $78 million in the league

and the highest average ticket price on the secondary market ($691).

4

The team’s value

has increased by 76 percent over the past three years since the relocation from Oakland,

California growing from $2.9 billion in 2019 to $5.1 billion in 2022.

5

In addition to hosting

the Raiders, the venue is used for large concerts and events such as for the 4 back-to-back

weekend shows by Korean Boy Band BTS on April 8,9, 15th and 16th, 2022 which drew

around 200,000 attendees.

6

In total the stadium hosted 107 events drawing nearly 1.7 million

attendees in 2022 according to the Las Vegas Stadium Authority.

7

Another major addition to the Las Vegas sports economy is T-Mobile Arena, which opened

in 2016. It is a $375 million multi-purpose facility, seating 20,000 sports fans, including Las

Vegas’ first major professional sports team, the National Hockey League’s (NHL) Vegas

Golden Knights. The arena supports a wide range of world-class sporting events, including

the Ultimate Fighting Championship (UFC), boxing, basketball, bull riding, as well as top-

name concerts and award shows. The $150 million Las Vegas Ballpark opened in 2019

with a capacity of 12,000 and is home to the Las Vegas Aviators Minor League Baseball

Team (MiLB). The Dollar Loan Center in Henderson was completed in March 2022, costing

$70 million and becoming the newest addition to the local sports economy. With a capacity of

Page 3

3 Singh, 2023.; 4 Alvarado, 2022.; 5 Forbes, 2022.; 6 Kaufman, 2022;

7 Las Vegas Stadium Authority, 2023.

A Summary of the Sports Economy in Las Vegas

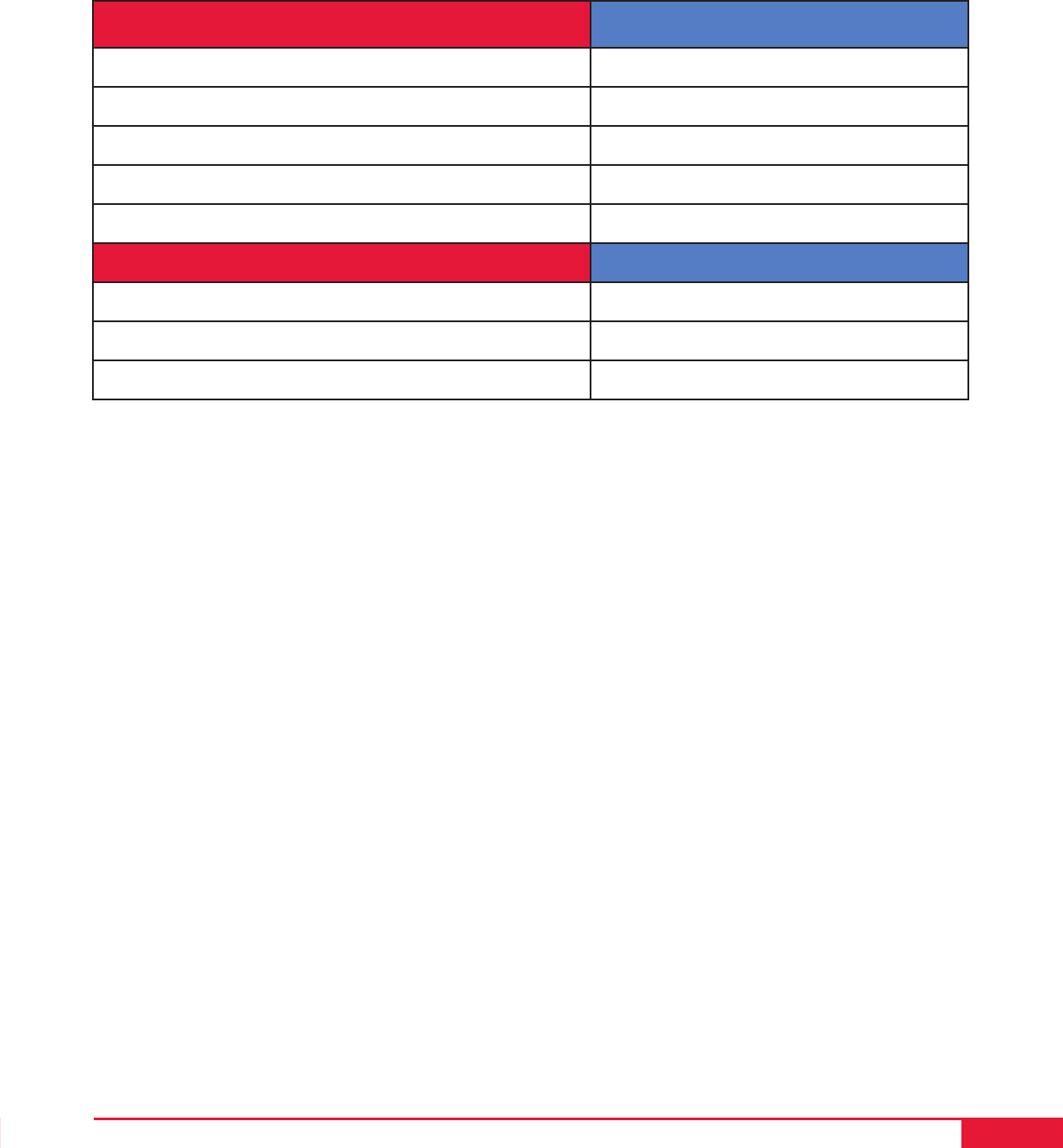

Planned Facilities Location

Madison Square Garden Sphere Sands Avenue and Koval Lane

Formula 1 Headquarters/Paddock Club Harmon Avenue and Koval Lane

Oak View Group Casino & NBA Arena Las Vegas Blvd and Blue Diamond

WNBA Aces 80,000 sq. foot practice facility West Henderson next to Raiders HQ

Indoor community sports facility Former Fiesta Henderson site

Proposed Facilities Location

MLS Stadium next to new OVG site Las Vegas Blvd and Warm Springs

Oakland A’s Major League Baseball Stadium Rio Casino site

All Net Resort and Arena Between Sahara and Fontainebleau

Sources: Bloomberg, 8 News Now, Sports Business Journal, Review Journal, Yogonet, Fox 5 Vegas

Figure 2. Planned and Proposed Facilities in Las Vegas as of January 1st,

Page 4

around 5,500, it is home to the American Hockey League (AHL) Henderson Silver Knights,

National Basketball Association G-League Ignite, and the Indoor Football League’s Vegas

Knight Hawks.

8

Collectively, these new facilities added a total of 104,000 seats to the city’s

entertainment venues and generated an additional $1.5 million in annual ticket sales.

9

According to data from the Las Vegas Convention and Visitors Authority (LVCVA), 41 spon-

sored sporting events took place in fiscal year 2022 (July 2021 to June 2022) that drew

nearly 1.8 million spectators or around 5.1 percent of total visitors to Las Vegas.

10

The

increase in professional sports in Las Vegas has also spilled over into the world of collegiate

sports. The National Collegiate Athletic Association (NCAA) has selected Las Vegas as

the host for nine postseason events and championships in Divisions I, II, and III sports, in

a mixture of Men’s and Women’s Basketball, Golf, Hockey, Soccer, and Bowling champi-

onships to be held from academic years 2022-23 through 2025-26.

11

According to LVCVA

data analyzed by the Sports Business Journal, between 2015 and 2019, just over 3 million

visitors from outside of North America came to Las Vegas. Of those international visitors,

13.1 percent said they were interested in or were going to a sporting event.

12

In March 2022, Liberty Media announced that Formula 1 would hold a Saturday night grand

prix race on the Las Vegas Strip on November 19, 2023. According to LVCVA, the event is

expected to generate 400,000 hotel room nights. Moreover, the LVCVA will spend more

than $19.5 million in fees and other costs over the three-year contract for races in Novem-

ber 2023, 2024, and 2025 (i.e., $6.5 million per year) and along with commitments from

the County on road upgrades.

13

The route will be more iconic than that of the 1981 route (the

only previous F1 race held in Las Vegas), passing through significant Las Vegas strip land-

marks. F1 has gained substantial viewership since Liberty Media Corp. bought the organi-

zation for $4.4 billion. U.S. viewership grew 28 percent to 1.21 million average TV viewers in

2022, setting a new record after increasing by 56 percent in 2021 to 949,000 average view-

ers.

13

The Formula 1 event is expected to blow by previously large multi day entertainment

events by ticketed spectators such the Grateful Dead’s farewell gig in Las Vegas in 1995, which

attracted 125,533 ticketed and non-ticketed spectators, and the Electric Daisy Carnival.

15

MGM Resorts International, the primary bidder, obtained the rights to host the 2026 Division

I Men’s Frozen Four and the 2023 Division I Men’s Basketball Regionals at T-Mobile Arena.

The 2023 NCAA National Collegiate Women’s Bowling Championship will also be held at

the South Point Hotel Casino & Spa, which is roughly 15 minutes from the Strip. MGM, Cae-

sars, and Wynn Resorts also played a significant role in luring the F1 race to Las Vegas for

the Grand Prix which will be hosted on the weekend of November 17th.

The LVCVA, Southern Nevada’s official destination marketing organization, anticipates

spending $90 million on advertising and marketing in fiscal year 2022–2023—an increase

of 10% from the prior year’s budget. The aim is to increase revenue for the 390 hotels with

a combined capacity of 168,393 rooms, which is expected to bring substantial tax revenue

from Las Vegas’ 13.38 percent lodging tax and boost the overall local economy. This

8 Anderson, 2022.; 9 Broughton, 2022.; 10 Bagger 2023.;

11 Visitlasvegas.com, 2020.; 12 Sports Business Journal, 2022..; 13 Snel, 2022.;

14 Hall, 2022.; 15 Weatherford, 2015.

A Summary of the Sports Economy in Las Vegas

Event Date Location

East-West Shrine Bowl February 2, 2023 Allegiant Stadium

Pro Bowl Games February 5, 2023 Allegiant Stadium

Pac-12 Women's Basketball Tournament March 1-5, 2023 Michelob ULTRA Arena

WCC Men’s and Women’s Basketball Tournament March 2-7, 2023 Orleans Arena

NASCAR Cup Series: Pennzoil 400 March 5, 2023 Las Vegas Motor Speedway

Mountain West Men’s and Women’s

Basketball Championships

March 5-11, 2023 Thomas & Mack Center

WAC Men’s and Women’s Basketball Tournament March 6-11, 2023

Michelob ULTRA Arena,

Orleans Arena

Big West Men’s and Women’s

Basketball Championships

March 7-11, 2023 Dollar Loan Center

Pac-12 Men's Basketball Tournament March 8-11, 2023 T-Mobile Arena

NCAA Division I Men's Basketball Regionals March 23-25, 2023 T-Mobile Arena

NIT Tournament Championships March 28-30, 2023 Orleans Arena

National Collegiate Women's Bowling Final April 14-15, 2023 South Point Hotel

NHRA Four-Wide Nationals April 14-16, 2023 Las Vegas Motor Speedway

NCAA Division I Men’s Golf Regional May 15-17, 2023 Bear’s Best Las Vegas

UFC International Fight Week July 3-9, 2023

Las Vegas Convention Center,

T-Mobile Arena, Resorts World

PGA Shriners Children's Open October 9-15, 2023 TPC Summerlin

NASCAR Cup Series: South Point 400 October 15, 2023 Las Vegas Motor Speedway

PBR Team Series Championship October 20-22, 2023 T-Mobile Arena

Formula 1 Las Vegas Grand Prix November 16-18, 2023 Las Vegas Strip

National Finals Rodeo December 7-16, 2023 Thomas & Mack Center

Super Bowl LVIII February 11, 2024 Allegiant Stadium

NCAA Division III Men’s Golf Championships May 2024

Boulder Creek Golf Club, The

Legacy Golf Club

NCAA Division I Women’s Golf Regional May 6-8, 2024 Spanish Trail Country Club

NCAA Division III Men's and Women's

Soccer Championships

December 2024 Peter Johann Soccer Field

Sources: NCAA, Sports Business Journal, Vegasshows.US

Page 5

A Summary of the Sports Economy in Las Vegas

Figure 3. Major Annual Sporting Events in Las Vegas (2023-2024)

Bold denotes yearly recurring event in Las Vegas

Page 6

increase in spending will be key to securing future sporting contracts in conjunction with

UNLV and local hospitality brands like MGM such as the aforementioned NCAA events,

Super Bowl LVIII in February 2024, and continuing contracts for the 2021 Concacaf Gold

Cup Finals; 2022 NHL All-Star Game; 2022 NFL Draft, NFL Pro Bowl, 2021 and 2023 WNBA

All Star Game, and the Pac-12, Mountain West, Big West, West Coast, and Western Athletic

Conference basketball championships.

II. Sports Employment in Clark County

Major Sports teams have helped boost the local economy not only by bringing additional visitors

to the local economy, but also by creating new valuable jobs in sports education and other

spectator sports. The Golden Knights’ successful debut and the Raiders’ decision to move to

the Valley has sharply increased sports and related activities, investment, and employment

over the past 5 years despite the COVID-19 recession.

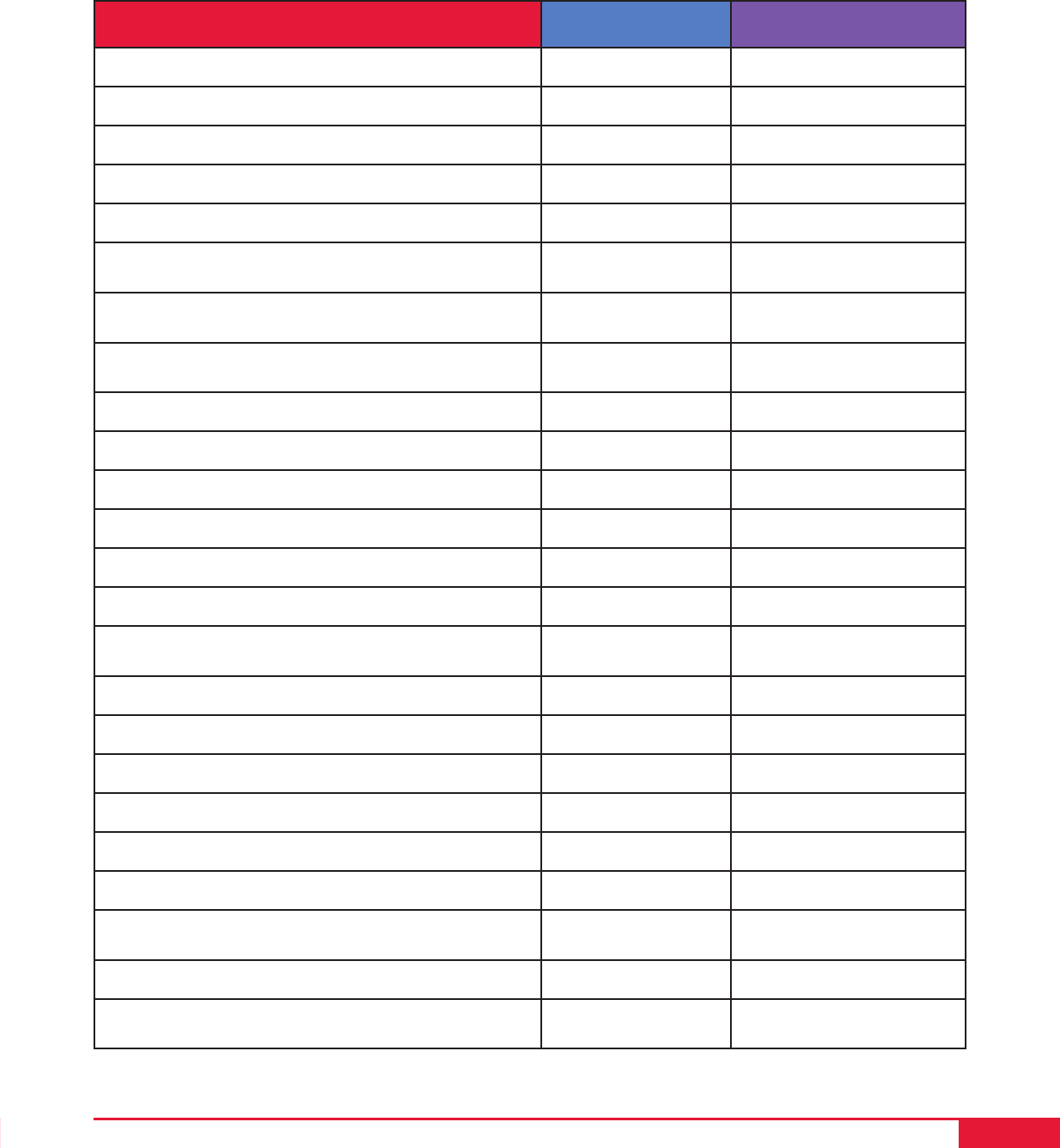

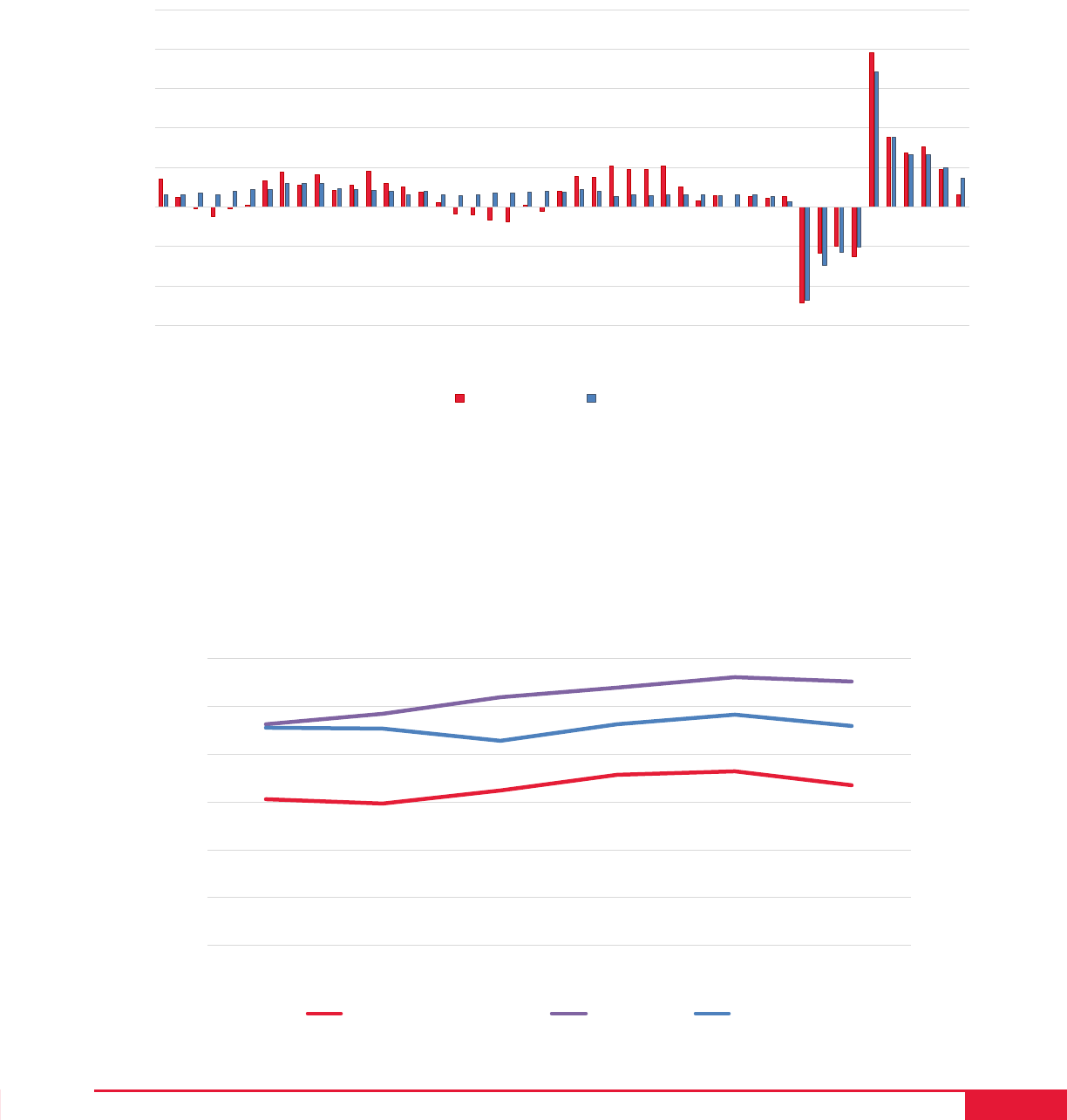

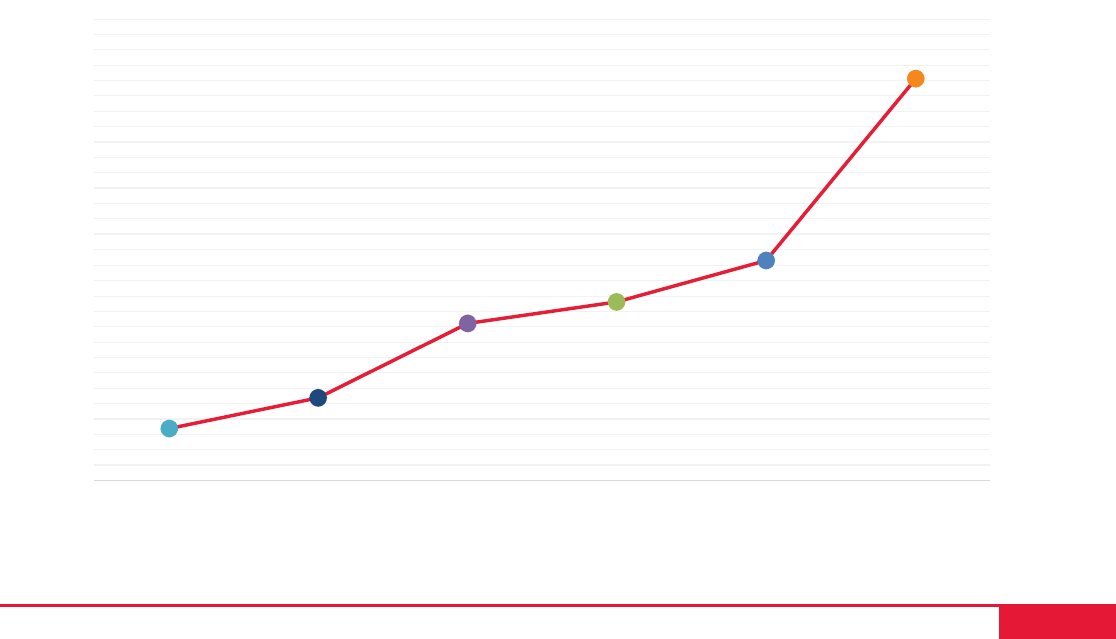

Figure 4 below shows the ratio of spectator sports employment compared to performing arts,

spectator sports, and related industries employment. The share of spectator sports em-

A Summary of the Sports Economy in Las Vegas

Figure 4. Ratio of Spectator Sports Employment (NAICS 7112) to the

Performing Arts, Spectator Sports, and Related Industries Employment

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

40.0%

2010Q1

2010Q3

2011Q1

2011Q3

2012Q1

2012Q3

2013Q1

2013Q3

2014Q1

2014Q3

2015Q1

2015Q3

2016Q1

2016Q3

2017Q1

2017Q3

2018Q1

2018Q3

2019Q1

2019Q3

2020Q1

2020Q3

2021Q1

2021Q3

2022Q1

2022Q3

Clark County US

Sources: DETR; BLS; CBER

Note: We only included private employment for the U.S. estimates.

Page 7

ployment soared in 2017, remained at in 2018 and the rst half of 2019, and, once again, had a

substantial jump in the last half of 2019 and early 2020. In 2017, Golden Knights debuted, and

the Raiders decided to move to Las Vegas. In 2019, the Aviators received increased

attention with their new stadium, Las Vegas Ballpark. In early 2020, the Raiders relocated to

Las Vegas and the Golden Knights announced a new minor-league franchise, the Henderson

Silver Knights.

Due to these sports teams, Las Vegas’ spectator sports employment in areas such as athletic

coaching, front oces, and retail shops experienced a less severe decline compared to overall

performing arts, spectator sports, and related industries employment during the COVID-19

recession. In 2020, the ratio increased sharply to 32.6 percent, surpassing the level of the U.S.

average in 2020Q4. Clark County Spectator employment experienced a slight decline of 0.5

percent in 2020, while the United States saw a much more signicant drop of 38.6 percent

during the pandemic. The performing arts, spectator sports, and related industries employ-

ment showed a smaller decrease of 30.8 percent due to the strong employment in spectator

sports compared to the 35.4 percent decrease for the United States. Despite an increase in

sports-related businesses and employment, the overall employment share is still lower at 19.8

percent compared to 26.9 percent for the United States in 2022Q1, indicating there may be

unfullled demand for sport related employment and establishments in Las Vegas.

Among spectator sports employment (NAICS 7112), sports-teams-and-clubs’ employment

(NAICS 711211) in Las Vegas soared by 1,930.5 percent from 59 jobs in 2010Q1 to 1,198 jobs

in 2022Q3 with a 12,815.7 percent gain in total wages over the same period. Other spectator

sports employment (NAICS 711219) also increased substantially in Las Vegas by 710.5

percent from 19 jobs in 2010Q1 to 154 jobs in 2022Q3, benetting from major and minor

league sports teams. Other spectator sports employment in Clark County hit their highest

level of 217 in 2019Q4. During the same period, the United States experienced 116.3 and 4.3

percent growth, respectively, for sports teams and clubs and other spectator sports

employment. Spectator sports employment does not include employment in stadium facilities

such as T-Mobile Arena and Allegiant Stadium. Event facilities employees are under a separate

category as Promoters of Performing Arts, Sports, and Similar Events with Facilities (NAICS

711310). In 2022Q3, 949 employees worked in facilities for performing arts, sports, and similar

events in Clark County, which grew by 461.5 percent from 2010Q1.

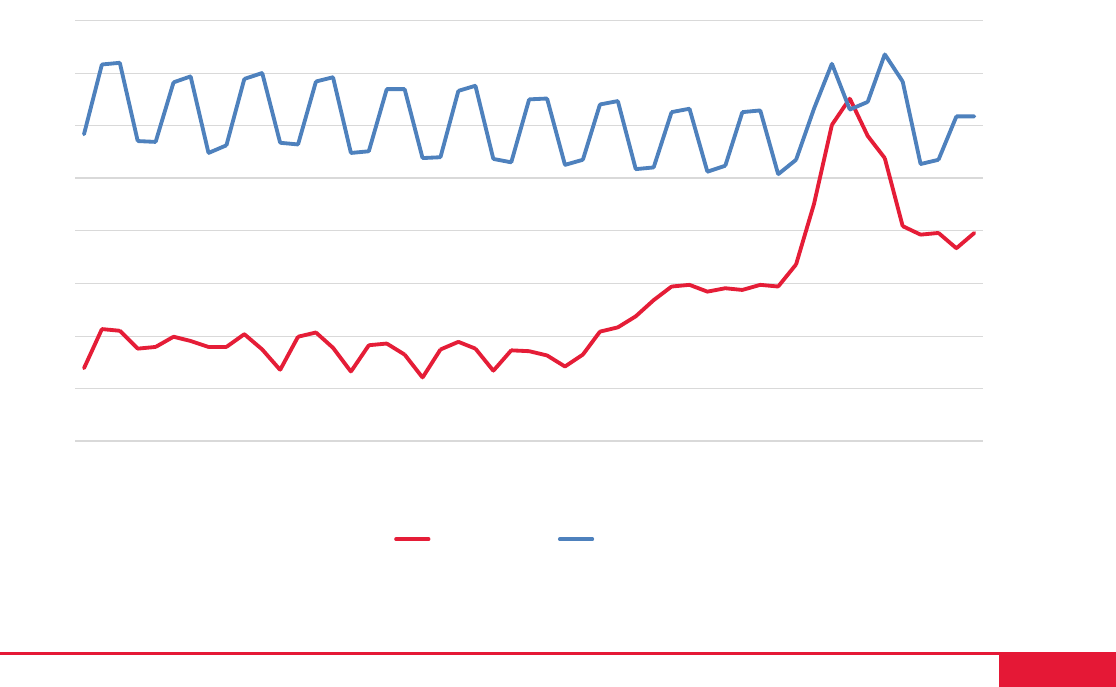

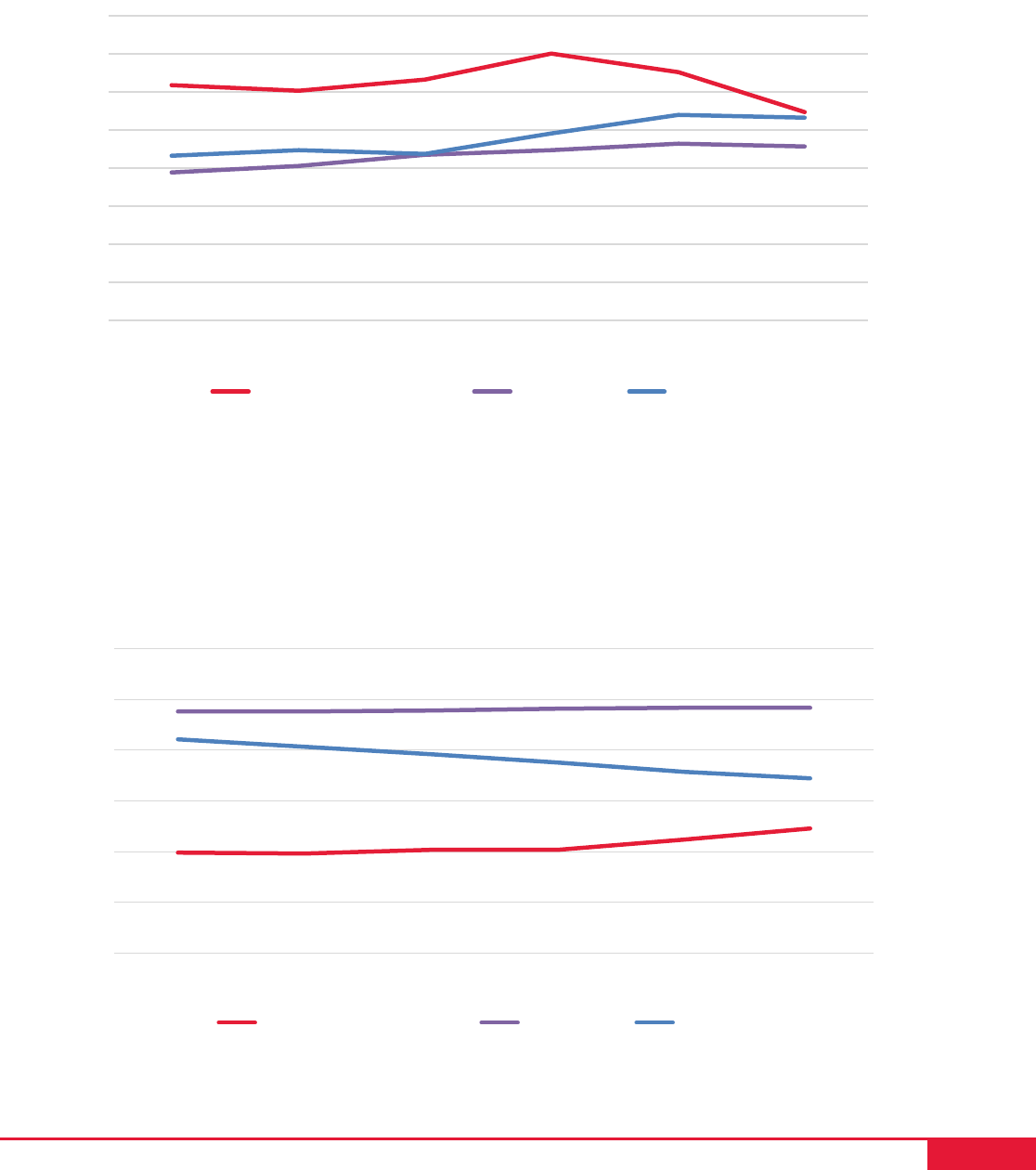

Thanks to locals’ increasing interest in sporting events, employment in sports and recreation

instruction has more than doubled from 314 jobs in 2010Q1 to 733 jobs in 2022Q3 (See

Figure 5 on the next page). Figure 6 (see page 9) exhibits year-over-year sports and recreation

instruction employment growth for Clark County and the United States. Note that Clark County

had substantially higher growth in employment between 2017Q1 and 2018Q3, thanks to the

emergence of major and minor league sports teams: Vegas Golden Knights (2017), Las Vegas

Aces (2018), and Las Vegas Lights FC (2018), etc. Clark County also had smaller declines and

higher gains from 2020Q1 to 2022Q1 as more teams were created or relocated to the Greater

Las Vegas area.

A Summary of the Sports Economy in Las Vegas

Page 8

A Summary of the Sports Economy in Las Vegas

Figure 5. Clark County Sports and Recreation Instruction Employment:

2010Q1 vs. 2022Q3

Sources: DETR; CBER

Note: The dots represent sports and recreation instruction establishments between Q1 2010 (green) and Q3

2022 (red). The sizes of the dots represent each establishment’s employment size.

Despite the large increase in sports and recreation instruction employment, the level still

remains below the U.S. average (see Figure 7 on the next page). That is, the ratio of private

sports and recreation instruction employment (NAICS 611620) to total private employment

stayed around 0.07 percent compared to 0.11 percent for the United States. The Orlando

MSA, whose economy is also largely dependent on the leisure and hospitality sector, reported

a slightly higher ratio of 0.09 percent in 2020 compared to the Las Vegas MSA. The ratio of

private sports and recreation instruction employment to private education employment, however,

indicated that Las Vegas has a larger share of sports and recreation instructors among all

educators with 5.5 percent in 2020 compared to 4.5 and 5.3 percent, respectively, for the

United States and Orlando (see Figure 8 on page 10). This occurs because Las Vegas has a

substantially lower share of private education employment, as only 1.2 percent of total private

employment in Las Vegas works for the private education sector compared to 2.4 and 1.7

percent for nationwide and Orlando, respectively (see Figure 9 on page 10).

Page 9

A Summary of the Sports Economy in Las Vegas

Figure 6. Sports and Recreation Instruction Year-Over-Year Employment

Growth: Clark County vs. US

-60.0%

-40.0%

-20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

2011Q1

2011Q3

2012Q1

2012Q3

2013Q1

2013Q3

2014Q1

2014Q3

2015Q1

2015Q3

2016Q1

2016Q3

2017Q1

2017Q3

2018Q1

2018Q3

2019Q1

2019Q3

2020Q1

2020Q3

2021Q1

2021Q3

2022Q1

2022Q3

Clark County US

Sources: DETR; BLS; CBER

Note: We only included private employment for the U.S. estimates.

0.00%

0.02%

0.04%

0.06%

0.08%

0.10%

0.12%

2015 2016 2017 2018 2019 2020

Las Vegas MSA US Orla ndo MSA

Sources: County Business Patterns (CBP), US Census; QCEW, BLS; CBER

Figure 7. Ratio of Private Sports and Recreation Instruction Employment

to Total Private Employment

Page 10

Figure 8. Ratio of Private Sports and Recreation Education to Private

Education Employment

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

2015 2016 2017 2018 2019 2020

Las Vegas MSA US Orla ndo MSA

Sources: County Business Patterns (CBP), US Census; QCEW, BLS; CBER

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

2015 2016 2017 2018 2019 2020

Las Vegas MSA US Orla ndo MSA

Sources: County Business Patterns (CBP), US Census; QCEW, BLS; CBERsus; QCEW, BLS; CBER

Figure 9. Ratio of Private Education Employment to Total Private

Employment

A Summary of the Sports Economy in Las Vegas

Page 11

16 LVCVA, 2023; 17 US Travel Association, 2019.; 18 CBER calculated by using

the room night occupied and average room rates from July 2021 to June 2022,

provided by LVCV.; 19 Heart+Mind Strategies, 2023. pages 9, 28.; 20 Heart+Mind

Strategies, 2023.pages25, 26.

Economic Impact of Sporting Events Visitors in Clark County:

Hosting major and minor league sporting events has attracted numerous visitors that

increases sales by local businesses. According to data from the LVCVA, they sponsored 41

sporting events that hosted more than 1.8 million attendees in scal year 2022.

16

According to

the U.S. Travel Association, sports travelers spend 3.9 nights with a party size of 3.2 people,

slightly more than the average leisure traveler.

17

Assuming 50 percent of the 1.8 million attendees come from out-of-town, then 900

thousand attendees visited from out-of-town and approximately 22,000 out-of-town

visitors or 6,860 parties per sporting event. The average daily room rate for FY2022 was

$158.85 for Las Vegas,

18

meaning that these 22,000 visitors spent about $4.25 million

(6,563*158.85*3.9) for rooms. That is we estimate, on average, $568,613 in room tax

collected per sporting event.

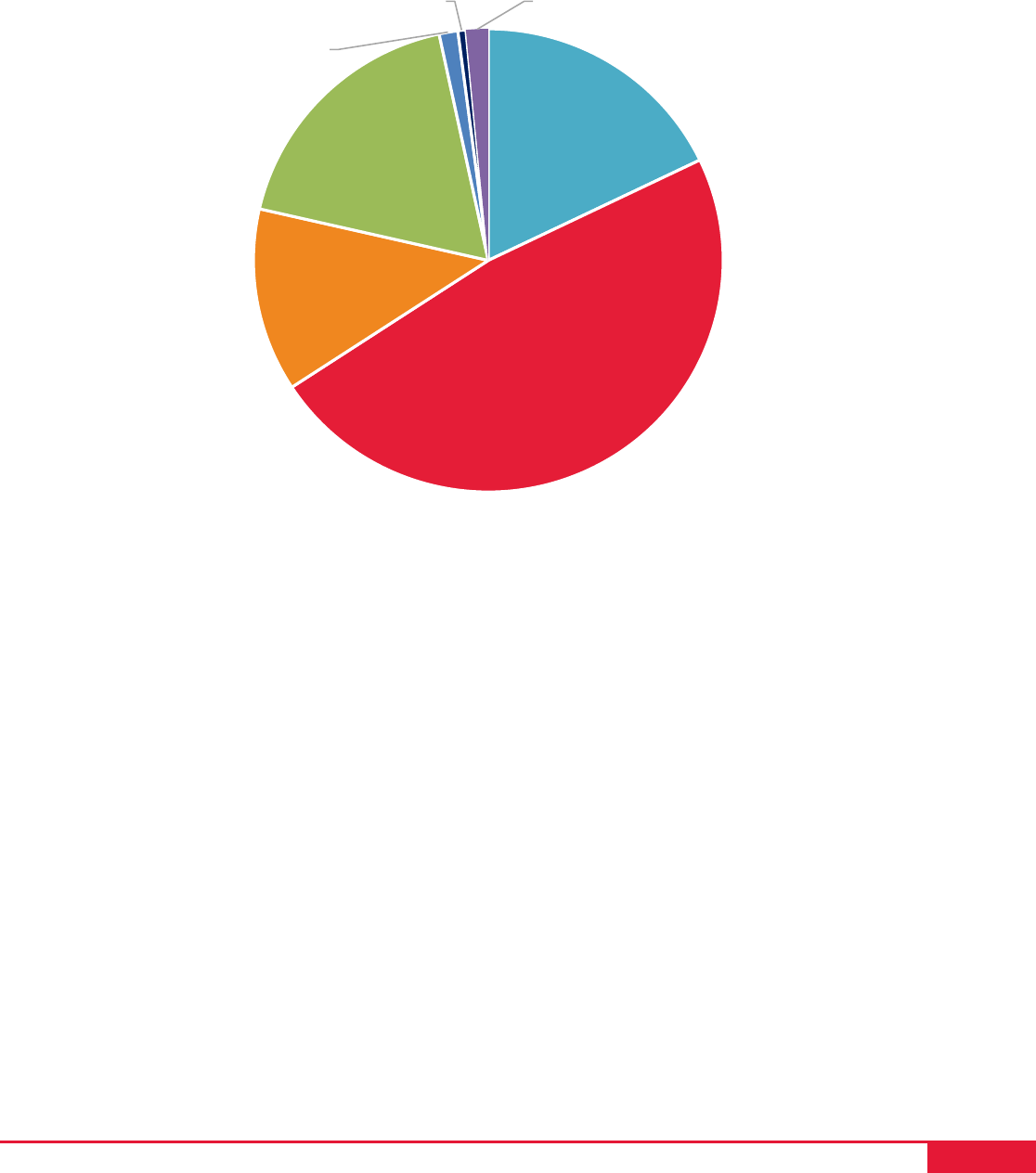

In addition, we estimate that, on average, a visitor spent about $1,084 based on LVCVA’s

survey data on visitor spending patterns (Figure 10). This does not include any gambling and

ticket purchases for shows/entertainment and sporting events, indicating that the actual

average can be larger than $1,084. We adjusted per-visitor spending by using the 2022

ination rate of 8.0 percent as FY2022 is from July 2021 to June 2022, assuming that half of

the out-of-town visitors visited during 2021.The ination-adjusted per-visitor spending is

estimated to be $1,048 in FY2022. As 22,000 visitors were estimated from outside Clark

County, these visitors were estimated to spend a total of $23.1 million per sporting event in

FY2022. As a result, we estimate that a sporting event in FY2022 generated, on average, $45

million in direct economic output from out of town visitors, for a total of $1.845 billion.

According to the 2022 Las Vegas Visitor Study, six percent of all visitors sampled reported

attending a sporting event, with 3 percent of visitors sampled responding that their main

reason for visiting Las Vegas was to attend a sporting event. This was slightly higher for

repeat visitors, 4 percent of whom responded that it was their main reason for visiting

compared to 1 percent for rst time visitors.

19

Among all visitors, the average spent on

sporting events doubled from 2019 to 2022, from $7.03 to $15.81. This is similar to trends in

2022 for food and beverage, shopping, local transportation, and live entertainment/concerts.

For those who visited and reported spending money, average trip expenditures was $271.58,

the third highest category after shows/entertainment ($309.76) and food and beverage

($527.13).

20

This seems to indicate that sports as a draw for visitors is growing, especially

for repeat visitors.

A Summary of the Sports Economy in Las Vegas

Page 12

III. Tales From the Turf

Professional Sports Impact on the Las Vegas Marketing Industry

With the rise of professional sports in Las Vegas over the past decade, a subsequent shift has

occurred in how some marketing dollars are spent attracting visitors to Las Vegas. The local

marketing industry has responded by creating new sub-genres, programming, and marketing

techniques to reach both locals and visitors. While it’s yet to be determined if growth in sports

has created new marketing and media rms, established rms have seen increased business

opportunities, along with new revenue streams, which translates into more jobs.

In an interview with R&R Partners, a long-time successful marketing and advertising agency,

they mentioned a renewed urgency in expanding the Las Vegas brand beyond traditional

audiences.

21

Professional sport offers opportunities to attract new visitors who are looking for

unique experiences beyond the traditional visitor options. That does not imply that locals are

missing out on sporting events. Leagues and sporting event host organizations (i.e., NCAA)

are allocating resources to appeal to the 2.4 million residents in the local Las Vegas market

and local marketing rms will likely see their business grow as efforts increase to attract fans

and viewers for both midweek and weekend events.

Figure 10. Estimated Spending per Visitor Excluding Ticket Sales

and Gambling Employment

Room,

$193.60

Food and

Drink, $519.23

Transportation,

$138.74

Shopping,

$195.74

Sightseeing,

$13.98

Miscelleneous,

$5.94

Parking,

$16.50

Graphic Sources: US Travel Association; LVCVA; CBER

21 Dondero, 2023.

A Summary of the Sports Economy in Las Vegas

Page 13

R&R Partners believes that Las Vegas is a unique city for sports marketing and prior to

professional sports teams arriving in Las Vegas, the industry did not have robust infrastructure

for promoting sporting events beyond the occasional pay-per-view event. With even more

professional teams on the horizon, growth in advertising and marketing is expected to continue

as the industry matures. With that maturation comes new challenges and demand for a

creative workforce. Specically, the sport teams and leagues, for example, Ultimate Fighting

Champion (UFC), need talented individuals who can market Las Vegas sports not only

nationally and internationally, but locally too. Marketing operations that once included

only one or two individuals, now require more than a dozen dedicated professionals,

especially when it comes to the promotion of very large sporting events such as the

National Football League’s (NFL) Superbowl or Formula 1. Advertising agencies like R&R

Partners have responded by creating specialized units and positions for those particular

events. Local television stations, newspapers, and radio stations have responded as well,

shifting resources towards new programming and coverage for local teams like KVVU Fox

5’s and Beasley Media Group’s partnership with the NFL’s Las Vegas Raiders.

22

Local businesses are benefiting from the presence of major teams and events, altering

their advertising budgets to incorporate professional athletes. Today you can’t drive on the

215 beltway or I-15 without seeing an athlete or team advertising a local business or promoting

a public message. Just ask a local if they have seen a billboard of former Golden Knights

player Ryan Reaves’s water smart campaign for the Southern Nevada Water Authority or

current Raiders player Hunter Renfrow advertisements for America First Credit Union. With

sponsorships come new business opportunities, such as Las Vegas based Allegiant Airlines

partnering with the NFL’s Las Vegas Raiders on travel packages that includes tickets, airfare,

and hotel for games at Allegiant Stadium.

23

An undervalued aspect of the rise of professional sports in Las Vegas is the expansion of

sports betting. The repeal in 2018 of the Professional and Amateur Sports Protection Act

(PAPSA) proliferated sports betting operations across the country. Today sports betting is

legal and operating in 33 states with 3 more states soon to be operational.

24

This new

frontier has created never before seen partnerships between the gaming industry with

professional sports leagues, teams, and sometimes even players themselves. An

enormous investment has been made by gaming operators and promoters to ramp up their

in-person and mobile sports betting operations and subsequent marketing campaigns to build

customer loyalty. Research by JustGamblers USA, an online gambling reference website,

using data from Google, found that Nevada was the most “sports obsessed state” in the

United States, with a monthly average 85,406 sport-related searches per 100,000 people.

25

This includes searches by the 40 million plus annual visitors a year to Las Vegas. With the

Super Bowl coming to Las Vegas in 2024 and being the second-ever Super Bowl to be held

in a state with legal sports betting (Arizona was the first with the 2023 Super Bowl), 2024

might just be an unprecedented opportunity for further expansion of sports betting and

connecting with new audiences.

Graphic Sources: US Travel Association; LVCVA; CBER

22 Gilbert, 2017.; 23 Allegiant, 2022.; 24 American Gaming Association, 2023.;

25 Coutanche, 2023

A Summary of the Sports Economy in Las Vegas

Page 14

The Resiliency of the Golf Industry in Las Vegas

Long before permanent professional sports came to Las Vegas, golf had already established

itself. The rst course opened in 1927 before the legalization of gambling in 1931. Las Vegas’

oldest operating golf course, the Las Vegas Golf Club has been in continual operation since

1938.

26

Nevada has 88 golf course facilities, with over 55 golf courses in Southern Nevada.

Over fty percent of the courses in Nevada are semi-private, requiring a daily fee. With the

decades-long drought along the Colorado River and severe water restrictions for outdoor use,

the number of “green” outdoor golf courses in Southern Nevada is likely xed for the foreseeable

future and current outdoor water use restrictions are transforming the look and feel of many

courses in the valley.

That isn’t to say that golf is a dying sport in Southern Nevada by any means. The xed number

of golf courses in the city is expected to lead to increased demand on each course as the local

population continues to grow. Additionally, the rise in sport tourism in the city has positively

impacted the local golf industry, with golf tourism in Nevada generating $744.3 million per

year.

27

Newer, less traditional styles or “non-green” golf facilities such as Top Golf and the

upcoming Atomic Range appeal to a broader clientele, proving to be popular not only with

golf acionados but also younger, diverse, and female demographic groups. This has created

opportunities to educate and build bridges with potential new players that are currently

underrepresented in the sport.

In addition to facilities like Top Golf fueling success, private courses are experiencing higher

demand despite the rising membership fees. Due to the Covid-19 pandemic, many more people

found the extra time to pick up these sport activities, including golf. Moreover, golf had the

advantage of being played outdoors. This increased interest for golf has persisted three years

after the worst impacts and restrictions of the pandemic. This includes junior golfers as well

as adults. Youth participation has increased from 594 junior golfers in 2020 to 1,070 in 2022

or an increase of 80 percent.

28

Overall, Nevada’s golf industry generates $1.242 billion per year in economic activity, mostly

in Southern Nevada. As of 2017, 17,503 total jobs exist in the Nevada golf industry, which

contribute to $701.3 million in wages and benets (SNGA, 2018). The golng industry has

been experiencing the same labor shortages as the broader leisure and hospitality industry

with an extremely high demand for workers. In some instances, interns are being offered

signing bonuses to work for golf courses during the peak of the golf season. Some jobs

and career elds in the golf industry include: golng coach, equipment manager, golf course

maintenance, golf course professional, general management, and even ownership and leasing.

29

The skills required are similar to other leisure and hospitality elds but with a focus on the

specifics and needs of the sport. Within UNLV’s Hospitality College, the PGA Golf

Management program produces aspiring golf professionals and connects them with

industry representatives.

26 Las Vegas Golf Hall Of Fame, 2022.; 27 Southern Nevada Golf Association, 2018.;

28 Southern Nevada Junior Golf Association, 2022. 29 Cain, 2022, page 15.

A Summary of the Sports Economy in Las Vegas

Page 15

One of the biggest roadblocks for new workers to enter the golf industry is a lack of knowledge

about how golf can be a career path on its own and provide both long-term personal and

professional success. While the Las Vegas golf industry has struggled with water restrictions,

labor shortages, and an aging demographic, the industry is evolving and protable in Las

Vegas, which provides opportunities for innovation and growth.

Clark County School District and Girls Flag Football

In 2009, the Clark County School District (CCSD) was challenged by the parent of a student-

athlete who alleged that CCSD was not in compliance with Title IX, which prohibits

discrimination based on sex in any education institution receiving federal funding. The

parents led a formal complaint, resulting in then Judge Brian Sandoval ruling that CCSD

needed to add a sport for girls. A UNLV expert in gender equity conducted a survey in cooperation

with CCSD to determine what sport was of the greatest interest to incoming 9th graders as

well as current 10th and 11th grade students. The survey found that ag football was the

sport students expressed the most interest in and that CCSD could quickly implement a girl’s

ag-football program. At the time, Florida and Alaska were the only two states with varsity

ag-football programs for girls at the high school level.

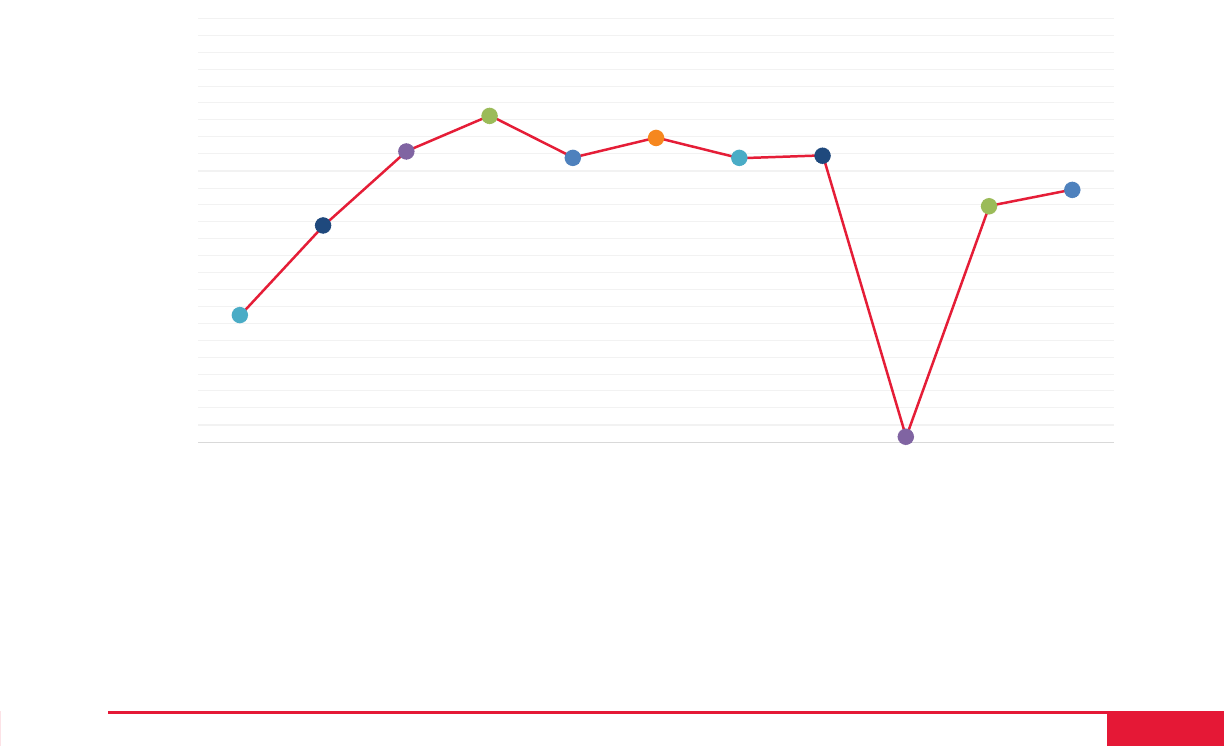

As Figure 11 shows, interest in girls ag football grew quickly in CCSD, nearly doubling from

the 2012 season to the 2013 season, and nearly tripling from the 2012 season to the 2015

Figure 11. Participation in Girls Flag Football in the Clark County School District

748

1277

1715

1926

1677

1795

1675

1690

30

1393

1489

0

500

1000

1500

2000

2500

2012-13 2013-14 2014-15 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22 2022-23

Total Girls

Year

Source: CCSD

A Summary of the Sports Economy in Las Vegas

Page 16

season. A sustained level of interest was evident from the 2016 season through the 2019

season. COVID resulted in the cessation of almost all high school sports in the 2020 season.

Interest rebounded after COVID to a respectable level with expectations that previously

sustained levels will be achieved in the coming years. The success of girls ag football at

CCSD is an example for other states to emulate. After initially beginning with one team at

each school (varsity), a need existed to expand opportunities to include a second team (junior

varsity), and then a third team (freshmen) to accommodate the growing interest among girls.

More recently, private schools such as Bishop Gorman and charter schools, such as SLAM

Academy have also offered ag football for girls.

As a nal indication of the value this sport offers to girls sport participation in southern

Nevada, several girls graduating from CCSD schools have now been offered college

scholarships to play collegiate flag football at NAIA colleges and universities. The

opportunity to attain a scholarship and college education was not even imaginable at the

time CCSD added ag football. Yet, this provides a unique experience to girls through CCSD

athletics. In total, ag football has created 15,415 sport participation opportunities for girls

in southern Nevada. There has been a similar pattern among young women and girls who play

youth hockey in Nevada. Between the 2017 and 2022 season, girls in youth hockey dramatically

increased 683 percent from 67 to 523 players under 18. The majority of the increase seems to

have come from players under the age of eight.

30

Figure 12. Participation in Women and Girls Youth Hockey

67

107

204

232

286

523

0

10 0

20 0

30 0

40 0

50 0

60 0

20 16-17 20 17-18 20 18-19 20 19-20 20 20-21 20 21-22

Total Girls and Women

Year

Source: CVegas Golden Knights

30 Vegas Golden Knights, 2023.

Page 17

IV. What’s Next for the Las Vegas Sports Economy

CBER forecasts that performing arts, spectator sports, and related industries employment

will grow by 12.4 percent or 2,944 permanent jobs from 2022 to 2030. This is a conservative

estimate, given the current preparations for a long-term presence of Formula 1 and

discussions about potentially hosting Major League Soccer (MLS), National Basketball

Association (NBA), and Major League Baseball (MLB) teams in Las Vegas and possibly

two additional stadiums and other scheduled sporting events. Occupational employment

projections by the the Bureau of Labor and Statistics forecasts that 95,500 entertainment

and sports occupations will be added between now and 2031, representing a 12.6 percent

increase, or 1.1 percent of all news jobs added over the coming decade.

31

In the meantime, Las Vegas marches on with high-prole sporting events. Allegiant Stadium held

the 2022 NFL Pro Bowl, which drew roughly 30,000 out-of-town visitors generating an estimated

economic impact of $54.7 million. The subsequent 2022 NFL Draft brought nearly 300,000 people

to the Strip over the three-day event.

32

The success of those events prompted the LVCVA to approve

funding up to $1.75 million for the 2023 Pro Bowl held in February 2023 with the rst Super Bowl

ever to be held in Las Vegas scheduled in February 2024 and estimated economic impact of $500

million.

33 34

Super Bowl LVIII is expected to generate nearly $700 million in economic impact. The

LVCVA expects an expense of $60 million to host the event, creating 4,597 full and part-time jobs

(equivalent to 2020 Super Bowl LV, Tampa, FL). The expected tax generation for the event will be

between $65 and $70 million, according to Steve Hill, LVCVA CEO, and president.

35

Another newcomer to the Las Vegas sports market, the National Lacrosse League’s (NLL) Las

Vegas Desert Dogs also looks to capitalize on playing under the bright lights of the Strip. The

team initiated play with the 2022/23 season at Michelob Ultra Arena, which is located inside the

Mandalay Bay Resort and Casino and is also home to the WNBA’s Aces.

MLS commissioner Don Garber recently conrmed that the soccer league was in discussions

with potential investors Wes Edens and Nassef Sawiris about establishing its 30th team in

Las Vegas in the foreseeable future. The Commissioner stated in early November 2022 that

the franchise looks to establish its 30th team “sometime in the rst half” of 2023, with both

Las Vegas and San Diego being serious candidates.

36

In addition to future professional sports

teams, the Oakland Athletics, a major league baseball team now in conict with the city

council of Oakland over suggestions for a new stadium, could head in the same direction in

coming to Las Vegas as their former neighbors at the Coliseum, the now Las Vegas Raiders.

The Oakland Athletics have submitted ve separate offers for plots of land in Las Vegas as

it considers options outside of the “Golden State” and agreed recently to purchase land on

Tropicana just west of the I-15. Then, in a surprise move, the Athletics moved the site of the

old Tropicana site at Tropicana and Las Vegas Boulevard in partnership with Bally’s.

A nal recent signicant announcement came in March 2022 when sports executive and

entrepreneur Tim Leiweke’s Oak View Group (world’s largest stadium and arena developer)

31 Bureau of Labor and Statistics, 2023, Table 1..; 32 Horwath, 2022.;

33 Akers, 2023.; 34 Lilly, 2022.; 35 Garcia, 2022.; 36 Sigal, 2022.

A Summary of the Sports Economy in Las Vegas

Page 18

acquired 25 acres of land in Las Vegas to build a $3 billion sports and entertainment district.

The location is along I-15 and I-215 across from a newly planned Brightline West high-speed

rail system and might begin construction in 2023.

37

The entertainment district will feature a

U.S. $1 billion, 20,000-seat, 850,000 square feet NBA basketball arena. The remainder will be

used to develop a casino hotel and additional amenities on the 25-acre property.

38

The future looks bright for Las Vegas in the world of professional and amateur sports though

many questions remain, which is why we pose the following questions below for consider-

ation for further research.

Additional questions for research:

• Are there sports deserts in Las Vegas and why?

• What are the lingering inequities in sports in Las Vegas?

• What does the data say about the impact of youth sports participation in Las Vegas as a

result of the increase of professional sports in Las Vegas?

• What are the jobs tied to the growth of the sports economy in Las Vegas? What are the

spillovers?

• What is the impact on public safety, sex tracking, and other negative externalities of the

sports economy in Las Vegas?

• What is the impact on quality of life in Southern Nevada and does having professional

sports attract new residents?

• Can we quantify the inuence of professional sport on the local marketing and advertising

industry or entrepreneurial activities?

• What is the point of saturation of professional sports in Las Vegas?

Want to learn more? Check out CBER’s GIS map on the Sports Economy:

https://arcg.is/108Ln92. The map includes all locations of all public and private sporting fa-

cilities, business establishments (unidentied), trails, parks, schools, community centers, and

heatmap of sport infrastructure.

V: Citations

Akers, Mick. “Athletics Target 3rd Las Vegas Ballpark Site.” Journal. Las Vegas Review-Journal.

Accessed March 16, 2023. https://www.reviewjournal.com/sports/athletics/athletics-target-

3rd-las-vegas-ballpark-site-2730372/.

Akers, Mick. “High-Speed Rail Project Construction Could Begin in ‘23.” Journal. Las Vegas

Review-Journal, Published November 14, 2022. https://www.reviewjournal.com/business/tour-

ism/high-speed-rail-project-construction-could-begin-in-23-2674524/.

Akers, Mick. “How will Vegas meet high expectations for 2024 Super Bowl.” Journal. Las Vegas

Review-Journal, Published February 11, 2023. https://www.reviewjournal.com/sports/football/

A Summary of the Sports Economy in Las Vegas

37 Akers, 2022; 38 Sloan, 2022.

Page 19

super-bowl/how-will-vegas-meet-high-expectations-for-2024-super-bowl-2727546/.

Allegiant Airlines. “Breaking News: Allegiant Specically Designs Exclusive Travel Packages

For NFL Fans.” Press Release. May 18, 2022. https://ir.allegiantair.com/news-releases/news-re-

lease-details/breaking-news-allegiant-specially-designs-exclusive-travel.

American Gaming Association. “Interactive U.S. Map: Sports Betting, State-level detail on types

of wagering allowed, key regulations, legal retail and online/mobile sportsbooks, and more.”

Accessed March 16, 2023. https://www.americangaming.org/research/state-gaming-map/.

Anderson, Mark. “Can Las Vegas Handle Another Major Sports Arena?” Journal. Las Vegas

Review-Journal, Published June 7, 2022. https://www.reviewjournal.com/sports/can-las-vegas-

handle-another-major-sports-arena-2587420/.

Barrickman, James. “Former UNLV Basketball Star Turned CEO of New Las Vegas Resort,

Sports Facility Reveals Plans.” https://www.fox5vegas.com. Accessed March 15, 2023. https://

www.fox5vegas.com/2022/10/20/former-unlv-basketball-star-turned-ceo-new-las-vegas-re-

sort-sports-facility-reveals-plans/.

Broughton, David. “Las Vegas: City of Sports and Entertainment.” The engine driving sports

tourism in Las Vegas is revving high with new teams, facilities and events drawing visitors

from around the world. Sports Business Journal, Published April 18, 2022. https://www.sports-

businessjournal.com/Journal/Issues/2022/04/18/In-Depth/Sports-Tourism.aspx.

Cain, C. P. & Cain, L. N. Golf’s Rebirth: Rapidly Evolving Applications in Hospitality and Sport

Management. Kendall Hunt (2022). Page 15.

Center for Business Economic Research. “May 09: Rebel Business Indicators.” UNLV Lee Busi-

ness School. Accessed March 15, 2023. https://conta.cc/3FrUjnX.

Clark County School District. “Girls Flag Football Participation.” Received January 23, 2023.

Coutanche, Pete. “Sports obsession: Nevada takes top place, according to a new release.” Just

Gamblers USA. Received March 21, 2023. https://justgamblers.com/.

Denk, David. “New Sports Facility Coming to Former Fiesta Henderson Site.” KLAS. KLAS, Pub-

lished December 14, 2022. https://www.8newsnow.com/news/local-news/new-sports-facili-

ty-coming-to-former-esta-henderson-site/.

Dondero, Rob and Gillins, Todd. R&R Partners. Interviewed on February 16 and March 22, 2023.

Garcia, Abel. “Las Vegas Convention and Visitors Authority Prepares to Put on a $60 Million

Super Bowl in 2024.” KTNV 13 Action News Las Vegas. KTNV 13 Action News Las Vegas,

Published January 12, 2022. https://www.ktnv.com/news/lvcva-gets-prepared-to-put-on-a-60-

million-super-bowl-in-2024.

Gilbert, Nestor. “10 Biggest Hotels in the World: The Highest Number of Rooms to Stay In.”

Financesonline.com. FinancesOnline.com, Modied February 2, 2023. https://nancesonline.

A Summary of the Sports Economy in Las Vegas

Page 20

com/10-biggest-hotelst-in-the-world-the-highest-number-of-rooms-to-stay-in/.

Hall, Andy. “Formula 1 Season Smashes U.S. Television Viewership Records.” ESPN Press

Room. Published November 22, 2022. https://espnpressroom.com/us/press-releas-

es/2022/11/formula-1-season-smashes-u-s-television-viewership-records/.

Heart+Mind Strategies, in preparation for Las Vegas Convention and Visitors Authority. “2022

Las Vegas Visitor Prole Study.” https://www.lvcva.com/research/visitor-proles/. Published

February, 2023.

Horwath, Bryan. “NFL Draft a Tailwind for Las Vegas’ Ongoing Economic Recovery.” VegasInc.

com, Published May 6, 2022. https://vegasinc.lasvegassun.com/news/2022/may/06/n-draft-

a-tailwind-for-las-vegas-ongoing-economi/.

Kaufman, Gil. “BTS’ ‘Permission to Dance on Stage’ Shows Drew Massive Global Crowds.’”

Billboard, Published April 18, 2022. https://www.billboard.com/music/pop/bts-permission-to-

dance-on-stage-attendance-1235060190/

Las Vegas Global Economic Alliance. “Southern Nevada Sports & Events Outlook.” Accessed

March 16, 2023. https://www.lvgea.org/wp-content/uploads/2018/12/LVGEA-SportsOut-

look-FINAL-72dpi.pdf.

Las Vegas Golf Hall of Fame. “Las Vegas Golf Hall of Fame.” Accessed March 16, 2023. http://

lasvegasgolfhof.com/-timeline.

Las Vegas Stadium Authority. “2022 Q4 Stadium Activity Reports.” Las Vegas Stadium Au-

thority Reports. Accessed March 22, 2023. http://www.lvstadiumauthority.com/docs/re-

ports/2022%20Q4%20Stadium%20Activity%20Report.pdf.

Lilly, Caitlin. “LVCVA Approves Funding for 2023 Pro Bowl in Las Vegas.” Fox 5 Vegas, ac-

cessed March 15, 2023. https://www.fox5vegas.com/2022/08/09/lvcva-approves-funding-

2023-pro-bowl-las-vegas/.

Manzano, Gilbert. “Raiders announce Las Vegas TV, radio partnerships.” Las Vegas Re-

view-Journal. June 1, 2017. https://www.reviewjournal.com/sports/raiders-n/raiders-an-

nounce-las-vegas-tv-radio-partnerships/.

NCAA. “Future NCAA Host Site Selections through 2026.” NCAA.com. February 22, 2023.

https://www.ncaa.com/news/ncaa/article/2020-10-14/future-ncaa-host-site-selections-

through-2026.

Shaw, Lucas. “Las Vegas $3 Billion Arena, Casino Project Planned by Oak View Group.”

Bloomberg.com. Published March 30, 2022. https://www.bloomberg.com/news/arti-

cles/2022-03-30/las-vegas-3-billion-arena-casino-project-planned-by-oak-view-group.

Sigal, Jonathan. “San Diego, Las Vegas Expansion in ‘Active Discussions’: MLS Commissioner

Don Garber .” MLS Soccer. Published November 4, 2022. https://www.mlssoccer.com/

news/san-diego-las-vegas-expansion-in-active-discussions-mls-commissioner-don-garber.

A Summary of the Sports Economy in Las Vegas

Page 21

Singh, Sanjesh. “Los Angeles, Las Vegas Top Cities with Most Expensive NFL Stadiums.” NBC

Sports. Published October 26, 2022. https://www.nbcsports.com/chicago/bears/n-most-ex-

pensive-stadium-list-includes-so-la-and-att-dallas.

Sloan, Katie. “Oak View Group Unveils Plans for $3B Arena, Casino Project South of the Las

Vegas Strip.” REBusinessOnline, Published March 31, 2022. https://rebusinessonline.com/oak-

view-group-unveils-plans-for-3b-arena-casino-project-south-of-the-las-vegas-strip/.

Snel, Alan. “Las Vegas Tourism Governing Panel OKS $19.5 Million, Three-Year Partnership

with Liberty for Formula One Race on Strip Starting November 2023.” LVSportsBiz. Published

May 10, 2022. https://lvsportsbiz.com/2022/05/10/las-vegas-tourism-governing-panel-oks-

19-5-million-three-year-partnership-with-liberty-for-formula-one-race-on-strip-starting-novem-

ber-2023/.

Sports Illustrated. “Las Vegas Raiders Listed among NFL’s Most Valuable Franchises.” Ac-

cessed March 16, 2023. https://www.si.com/n/raiders/news/las-vegas-raiders-forbes-list-n-

most-valuable-franchises-mark-al-davis-ranked-ninth.

Southern Nevada Golf Association. “The Economic Impact of Nevada Golf - SNGA.” Accessed

March 16, 2023. https://snga.org/wp-content/uploads/NV-Golf-Report-19.pdf.

“Sports in the Las Vegas Metropolitan Area.” Wikimedia Foundation. Accessed March 16, 2023.

https://en.wikipedia.org/wiki/Sports_in_the_Las_Vegas_metropolitan_area.

“U.S. Travel and Tourism Overview (2019) - U.S. Travel Association.” Accessed March 16, 2023.

https://www.ustravel.org/system/les/media_root/document/Research_Fact-Sheet_US-Travel-

and-Tourism-Overview.pdf.

“Upcoming NCAA Events in Las Vegas: 2022–2026.” Las Vegas Convention and Visitors Au-

thority. Las Vegas Convention and Visitors Authority. Published July 14, 2022. https://www.

visitlasvegas.com/experience/post/ncaa-comes-to-vegas/.

Vegas Golden Knights. “Youth Hockey Numbers.” Received March 14, 2023.

Vegas Shows. “Las Vegas Sporting Events 2023/2024.” Las Vegas Shows. Accessed Novem-

ber 2, 2022. https://vegasshows.us/las-vegas-sporting-events/.

Weatherford, Mike. “Reecting on the Grateful Dead’s history in Las Vegas.” Las Vegas Re-

view-Journal. Published November 26, 2015. https://www.reviewjournal.com/entertainment/

music/reecting-on-the-grateful-deads-history-in-las-vegas/.

Yamashita, Andy. “New Aces training facility ‘setting a standard for women’s sports.’” Las

Vegas Review-Journal. Published November 17, 2022. https://www.reviewjournal.com/sports/

aces/new-aces-training-facility-setting-a-standard-for-womens-sports-2678500/.

Yogonet. “Las Vegas Pushing for 30th MLS Franchise with Potential Stadium Site at Las Vegas

Boulevard.” Yogonet International. Accessed March 15, 2023. https://www.yogonet.com/inter-

national/news/2022/11/04/64914-las-vegas-pushing-for-30th-mls-franchise-with-potential-sta-

A Summary of the Sports Economy in Las Vegas