Congressional Response Report

Issuance of Social Security

Statements

A-03-18-50724 | February 2019

WEB: OIG.SSA.GOV | FACEBOOK: OIGSSA | TWITTER: @THESSAOIG | YOUTUBE: THESSAOIG

6401

SECURITY BOULEVARD | BALTIMORE, MD 21235-0001

February 14, 2019

The Honorable Tom Reed

Ranking Member, Subcommittee on Social Security

Committee on Ways and Means

House of Representatives

Washington, DC 20515

Dear Mr. Reed:

In a June 12, 2018 letter, Sam Johnson, former Chairman, and Representative Vern Buchanan

asked that we review how the Social Security Administration (SSA) mails Social Security

Statements and who receives them.

My office is committed to combating fraud, waste, and abuse in SSA’s operations and programs.

The report highlights various facts pertaining to the issues raised in their letter. To ensure SSA is

aware of the information provided to your office, we are forwarding a copy of this report to the

Agency.

If you have any questions concerning this matter, please call me or have your staff contact

Walter Bayer, Congressional and Intragovernmental Liaison, at (202) 358-6319.

Sincerely,

Gail S. Ennis

Inspector General

Enclosure

cc:

Commissioner of Social Security

WEB: OIG.SSA.GOV | FACEBOOK: OIGSSA | TWITTER: @THESSAOIG | YOUTUBE: THESSAOIG

6401

SECURITY BOULEVARD | BALTIMORE, MD 21235-0001

February 14, 2019

The Honorable Vern Buchanan

House of Representatives

Washington, DC 20515

Dear Mr. Buchanan:

In a June 12, 2018 letter, you and Sam Johnson, former Chairman, Subcommittee on Social

Security, Committee on Ways and Means, asked that we review how the Social Security

Administration (SSA) mails Social Security Statements and who receives them.

My office is committed to combating fraud, waste, and abuse in SSA’s operations and programs.

Thank you for bringing your concerns to the attention of the Office of the Inspector General.

The report highlights various facts pertaining to the issues raised in your letter. To ensure SSA is

aware of the information provided to your office, we are forwarding a copy of this report to the

Agency.

If you have any questions concerning this matter, please call me or have your staff contact

Walter Bayer, Congressional and Intragovernmental Liaison, at (202) 358-6319.

Sincerely,

Gail S. Ennis

Inspector General

Enclosure

cc:

Commissioner of Social Security

Issuance of Social Security Statements

A-03-18-50724

February 2019 Office of Audit Report Summary

Objective

To answer congressional questions

about the Social Security

Administration’s (SSA) issuance of

Social Security Statements.

Background

SSA provides Social Security

Statements (Statement) to individuals

who worked under the Social Security

program. The Statement includes

information about the individual’s

reported earnings and future Social

Security benefits for the individual and

his/her family. Section 1143 of the

Social Security Act requires that SSA

send Statements to individuals who are

age 25 and older, who are not

receiving Social Security benefits

based on their own earnings records,

and for whom the Agency can obtain

current addresses. SSA mails the

Statement about 3 months before the

individual’s birthday.

In May 2012, SSA implemented

my Social Security, an online account

where registered users can access their

Statements online at any time. As of

Fiscal Year (FY) 2018, there were

about 38.8 million registered users of

my Social Security. Because registered

users can access their Statements

anytime via my Social Security, SSA

excludes them from receiving

automatic Statements.

Results of Review

In FYs 2010 to 2018, SSA mailed approximately 381 million paper

Statements (both automatic and on request). The Agency mailed

about 252 million paper Statements in FYs 2010 to 2013 primarily

to individuals who were age 25 and older and not receiving Social

Security benefits. Between FYs 2014 and 2018, citing budgetary

issues, the Agency reduced the number of paper Statements by

modifying the age groups to whom SSA mailed Statements. This

resulted in the Agency mailing only about 129 million paper

Statements during this time period.

Moreover, the number of individuals who accessed their Statements

online via my Social Security increased every year, ranging from

1.9 million in FY 2012 to 16.8 million in FY 2018. However, the

percentage of registered my Social Security users who accessed

their Statements online declined annually from 96 percent in

FY 2012 to 43 percent in FY 2018.

The costs for printing and mailing paper Statements decreased from

FY 2010 to 2018 because the Agency changed the age groups to

whom it mailed paper Statements. In FY 2010, SSA spent about

$65 million to print and mail approximately 155 million

Statements, and, in FY 2018, the Agency spent about $7.6 million

to print and mail about 14.6 million Statements.

Finally, the contract awarded to print and mail paper Statements

allowed the Agency to vary the number of Statements mailed

annually. The 5-year contract, scheduled to expire in August 2019,

estimated the Agency would order 45 million Statements annually.

However, it allowed for a 25-percent increase or decrease in

Statements to allow flexibility if SSA decided to modify the age

groups to whom it mailed Statements and avoid re-soliciting the

contract.

Issuance of Social Security Statements (A-03-18-50724)

TABLE OF CONTENTS

Objective ..........................................................................................................................................1

Background ......................................................................................................................................1

Results of Review ............................................................................................................................3

Issuance of Paper Social Security Statements ...........................................................................3

FYs 2010 to 2013 .................................................................................................................4

FYs 2014 to 2018 .................................................................................................................5

Issuance of Online Social Security Statements ..........................................................................6

Cost of Issuing Social Security Statements ...............................................................................7

Printing Contract for Social Security Statements ......................................................................8

Conclusions ......................................................................................................................................9

Agency Comments ...........................................................................................................................9

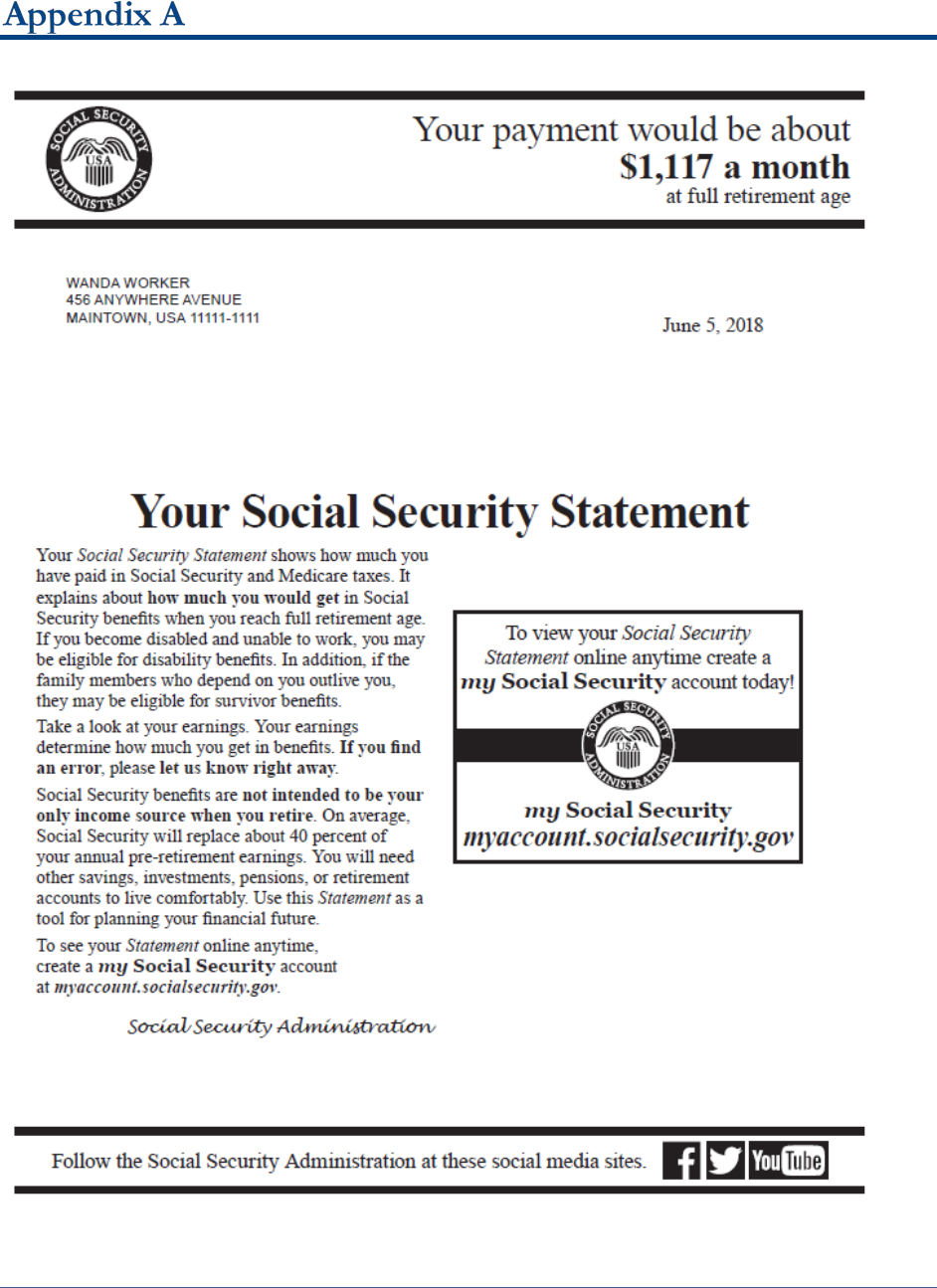

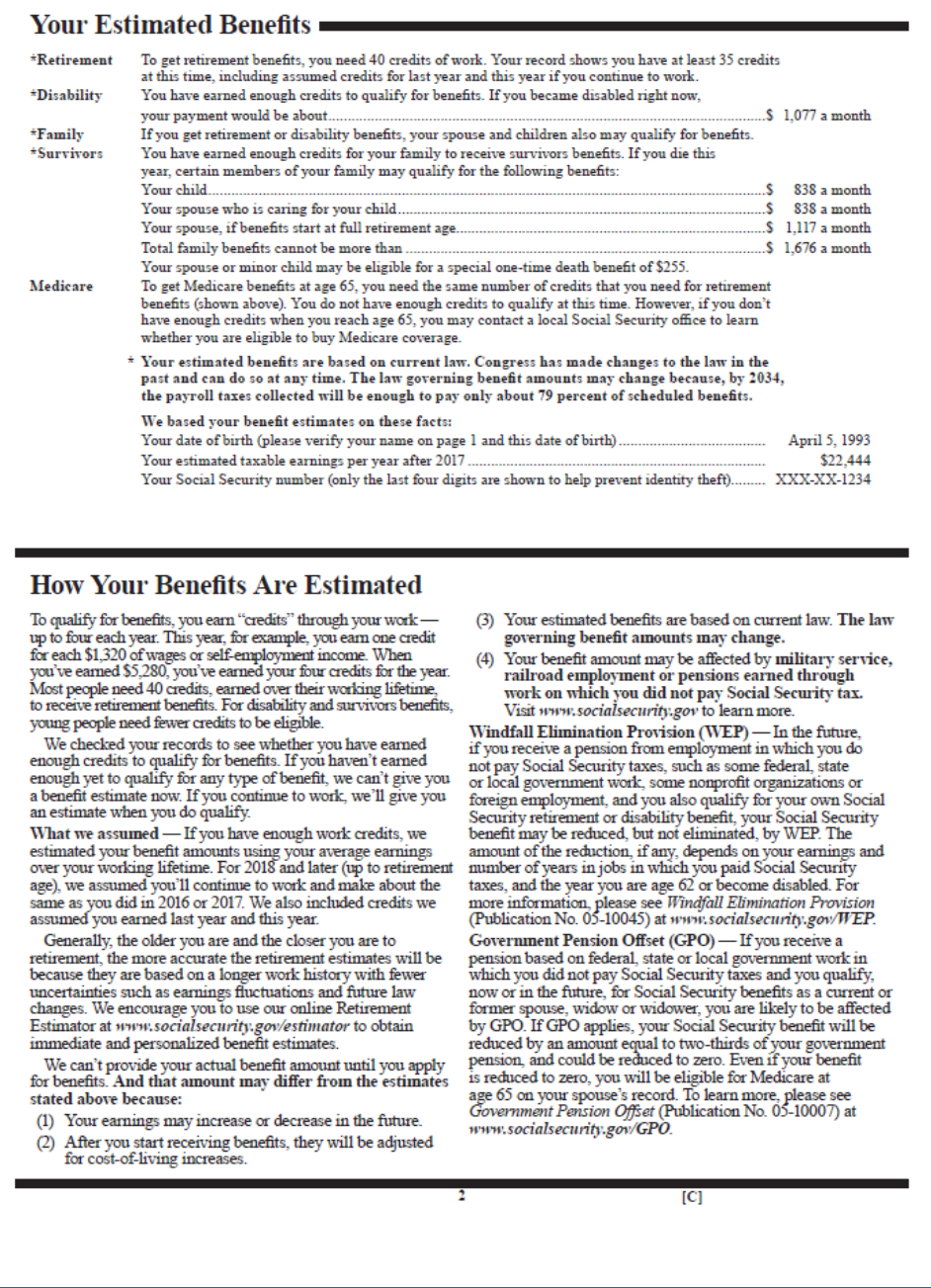

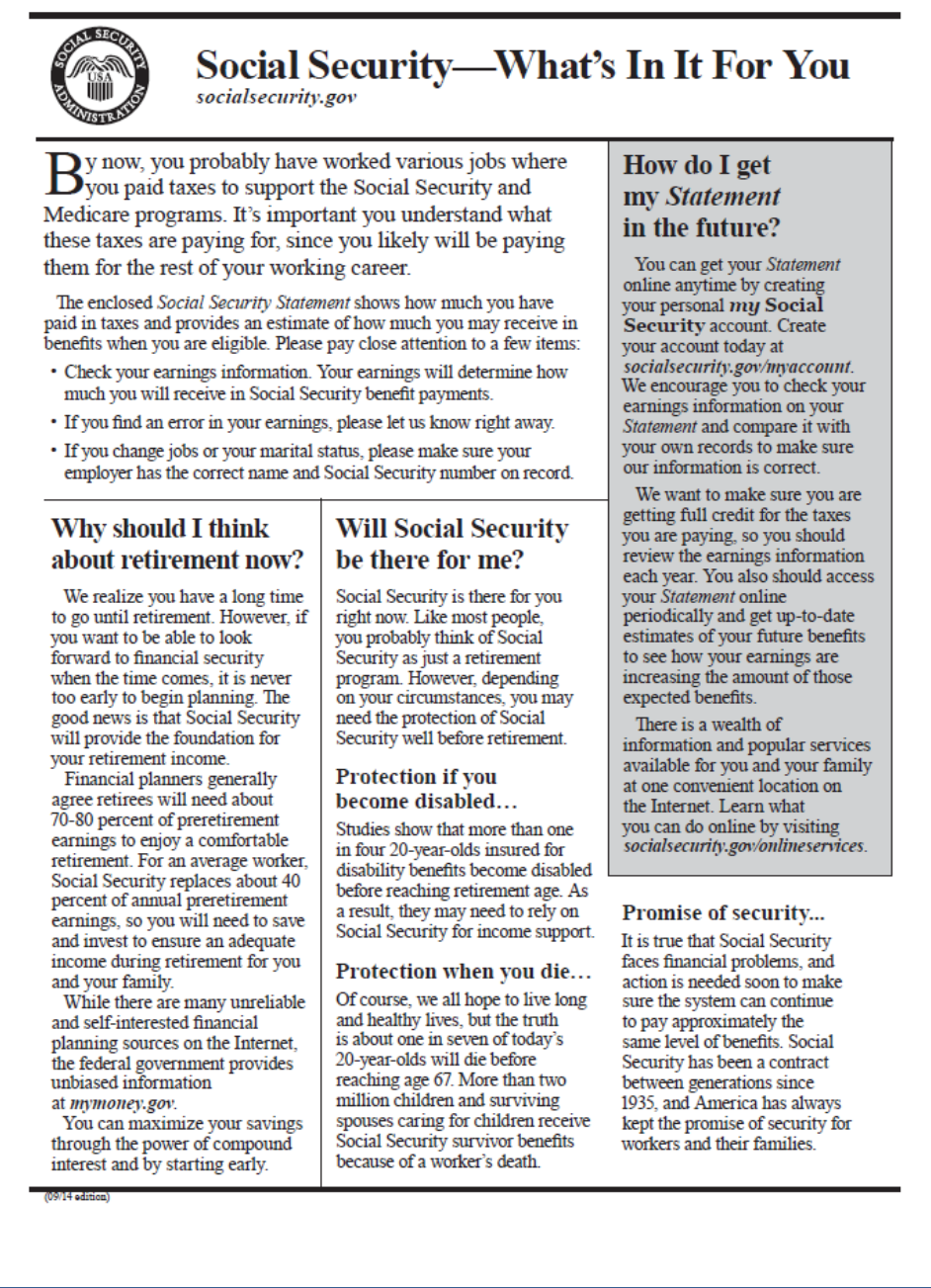

– Example Social Security Statement .................................................................... A-1

– Congressional Request Letter ............................................................................. B-1

– Scope and Methodology ..................................................................................... C-1

– Agency Comments .............................................................................................. D-1

Issuance of Social Security Statements (A-03-18-50724)

ABBREVIATIONS

Form SSA-7004-SM-OP1 Request for an Earnings and Benefit Estimate Statement

Form SSA-7005-SM-SI Social Security Statement

FY Fiscal Year

OIG Office of the Inspector General

SSA Social Security Administration

Statement Social Security Statement

U.S.C. United States Code

Issuance of Social Security Statements (A-03-18-50724) 1

OBJECTIVE

Our objective was to answer congressional questions about the Social Security Administration’s

(SSA) Social Security Statements.

BACKGROUND

Section 1143 of the Social Security Act,

1

as amended, requires that SSA provide a Social Security

Statement (Statement)

2

annually, without request, to all individuals age 25 and older who are not

receiving Social Security benefits based on their own earning records and for whom SSA can

determine current mailing addresses.

3

The purpose of the Statement is threefold: inform

individuals about their Social Security benefits, help individuals plan for their financial futures,

and ensure individuals’ earnings records are accurate.

4

The Statement provides each worker

an estimate of the monthly retirement benefit the worker would receive at full retirement age,

age 70, and age 62;

an estimate of the amount of monthly disability benefit the worker could receive should

he/she become disabled;

an estimate of the monthly benefit the worker’s family could receive should the worker die;

a year-by-year display of the worker’s earnings that have been reported to Social Security;

and

a total of the Social Security taxes paid by the worker and his/her employer(s) over the

worker’s career.

5

1

Social Security Act, 42. U.S.C § 1320b-13.

2

Social Security Statement, (Form SSA-7005-SM-SI).

3

SSA obtains addresses for automatic Statements from the Internal Revenue Service’s taxpayer Individual Master

File and revenue agencies in Puerto Rico and the Virgin Islands for individuals living in those locations who have

not filed Federal tax returns.

4

Social Security Statement (Form SSA-7005-SM-SI).

5

See Appendix A for an example of the Statement. In 2006, SSA also began sending automatic Statements to

individuals who had only non-covered earnings. The Statement highlights information about the Windfall

Elimination Provision and Government Person Offset, which reduce benefits for individuals or their dependents

whose work histories include jobs for which they were entitled to pensions and were not subject to Social Security

payroll taxes.

Issuance of Social Security Statements (A-03-18-50724) 2

Since August 1988, SSA has provided statements of recorded earnings and estimates of Social

Security benefits to Social Security numberholders upon request.

6

In Fiscal Year (FY) 1995,

SSA started issuing automatic Statements to eligible individuals age 60 and older and continued

these mailings until FY 1999. In FY 2000, SSA expanded the program to all individuals age 25

and older and began mailing the annual automatic Statements to eligible individuals about

3 months before their birthdays. The automatic Statement does not affect a worker’s right to

request a Statement at any time. SSA provides the information on Statements to a commercial

contractor which prints and mails automatic Statements.

7

The on-request Statements are printed

and mailed by SSA’s print-mail facility.

In May 2012, SSA implemented my Social Security, an online account where registered users

can access important information and SSA services at any time. To establish a

my Social Security account, an individual must be at least age 18 and have a valid email address,

Social Security number, and U.S. mailing address. As of FY 2018, there were about 38.8 million

registered my Social Security users. Because registered users can access their Statements

anytime via my Social Security, SSA excludes them from receiving automatic Statements by

mail even if they never accessed the Statement online. When my Social Security was

implemented in May 2012, customers were given an option to receive paper Statements.

However, this delivery preference was eliminated in September 2012. Therefore, anyone who

signed up after September 2012 does not receive paper Statements.

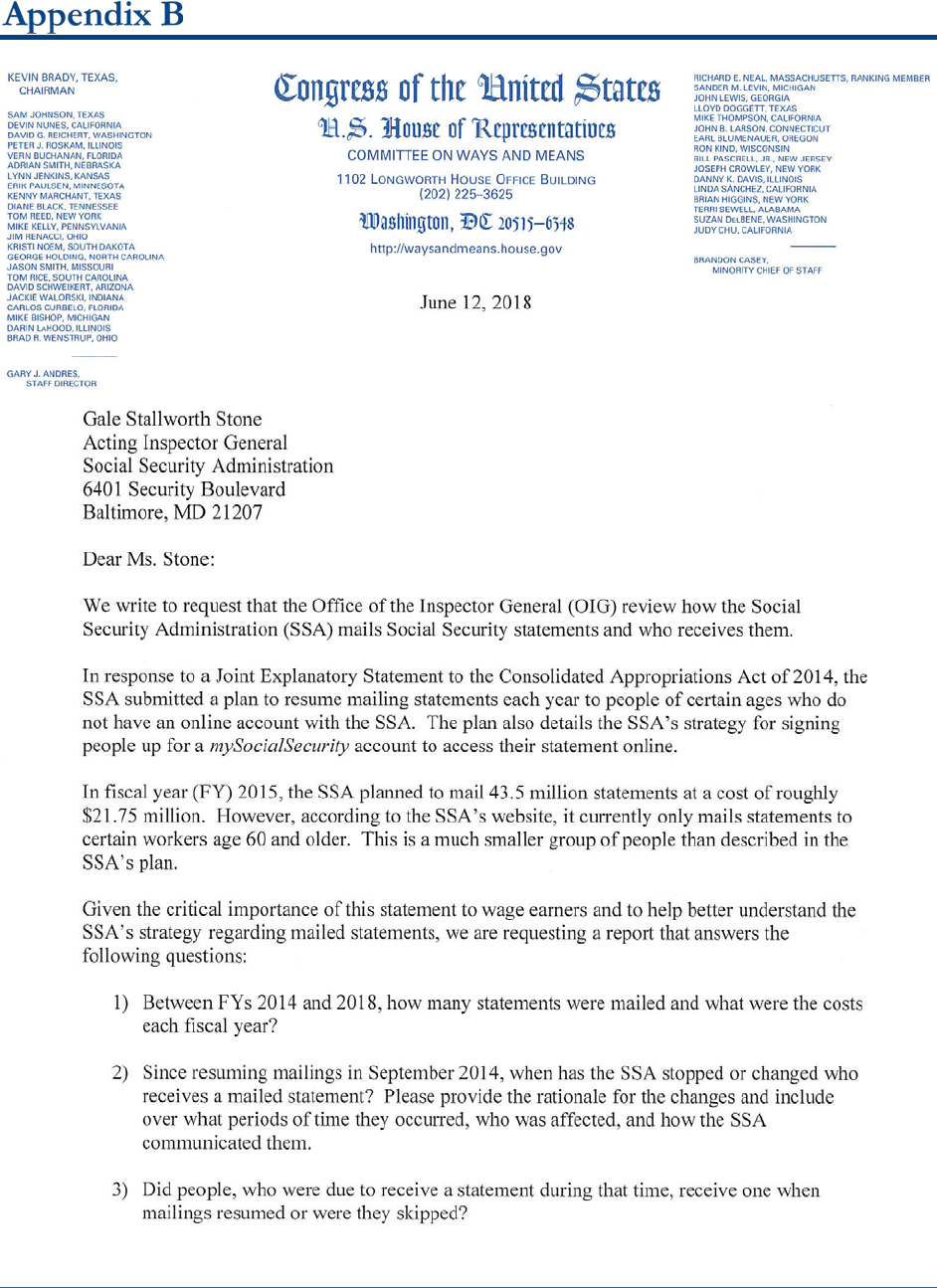

On June 12, 2018, Sam Johnson, former Chairman, and Vern Buchanan, former Member,

Subcommittee on Social Security, requested that we review how SSA mails Statements and who

receives them, see Appendix B. Specifically, they requested we determine the following.

1. Between FYs 2014 and 2018, how many Statements were mailed and what were the costs

each fiscal year?

2. Since resuming mailings in September 2014, when has SSA stopped or changed who

receives a mailed Statement? Please provide the rationale for the changes and include over

what periods they occurred, who was affected, and how SSA communicated them.

3. Did people, who were due to receive a Statement during that time, receive one when mailings

resumed or were they skipped?

4. What is the current printing contract’s period of performance and how does the contract

address changes or stoppages? What is SSA’s plan for a new contract?

6

These Statements were mailed as a result of individuals completing a paper Request for an Earnings and Benefit

Estimate Statement, (Form SSA-7004-SM-OP1) or a similar form through SSA’s Website.

7

The contractor employees are subject to suitability background checks.

Issuance of Social Security Statements (A-03-18-50724) 3

RESULTS OF REVIEW

In FYs 2010 to 2018, SSA mailed approximately 381 million paper Statements (both automatic

and on request). The Agency mailed about 252 million paper Statements in FYs 2010 to 2013

primarily to individuals who were age 25 and older and not receiving Social Security benefits.

Between FYs 2014 and 2018, citing budgetary issues, the Agency reduced the number of paper

Statements by modifying the age groups to whom it mailed the Statements. This reduction

resulted in the Agency mailing only about 129 million paper Statements.

Moreover, the number of individuals who accessed their Statements via my Social Security

increased from 1.9 million in FY 2012 to 16.8 million in FY 2018. However, the percentage of

registered my Social Security users who accessed their Statements online declined from

96 percent in FY 2012 to 43 percent in FY 2018.

The costs of printing and mailing paper Statements decreased from FY 2010 to FY 2018 because

SSA changed the age groups to whom it mailed paper Statements and Statements were available

online. In FYs 2010 to 2018, SSA spent about $174 million to mail 381 million paper

Statements. In FY 2010, it cost about $65 million to mail approximately 155 million Statements,

and, in FY 2018, it cost $7.6 million to mail about 14.6 million Statements.

Finally, the contract SSA awarded to print and mail the paper Statements allows the number of

Statements mailed annually to fluctuate. The 5-year contract, which is scheduled to expire in

August 2019, estimates 45 million Statements will be mailed annually. However, it allows for a

25-percent increase or decrease in Statements to allow flexibility if SSA modifies the age groups

to whom it mails Statements and avoid re-soliciting the contract.

Issuance of Paper Social Security Statements

As shown in Table 1, from FYs 2010 to 2018, SSA printed and mailed approximately

381 million paper Statements to individuals to inform them about their lifetime earnings and

future benefits. During these 9 years, the Agency mailed about 379 million automatic

Statements to individuals. Additionally, it mailed approximately 2 million Statements to

individuals upon request.

Issuance of Social Security Statements (A-03-18-50724) 4

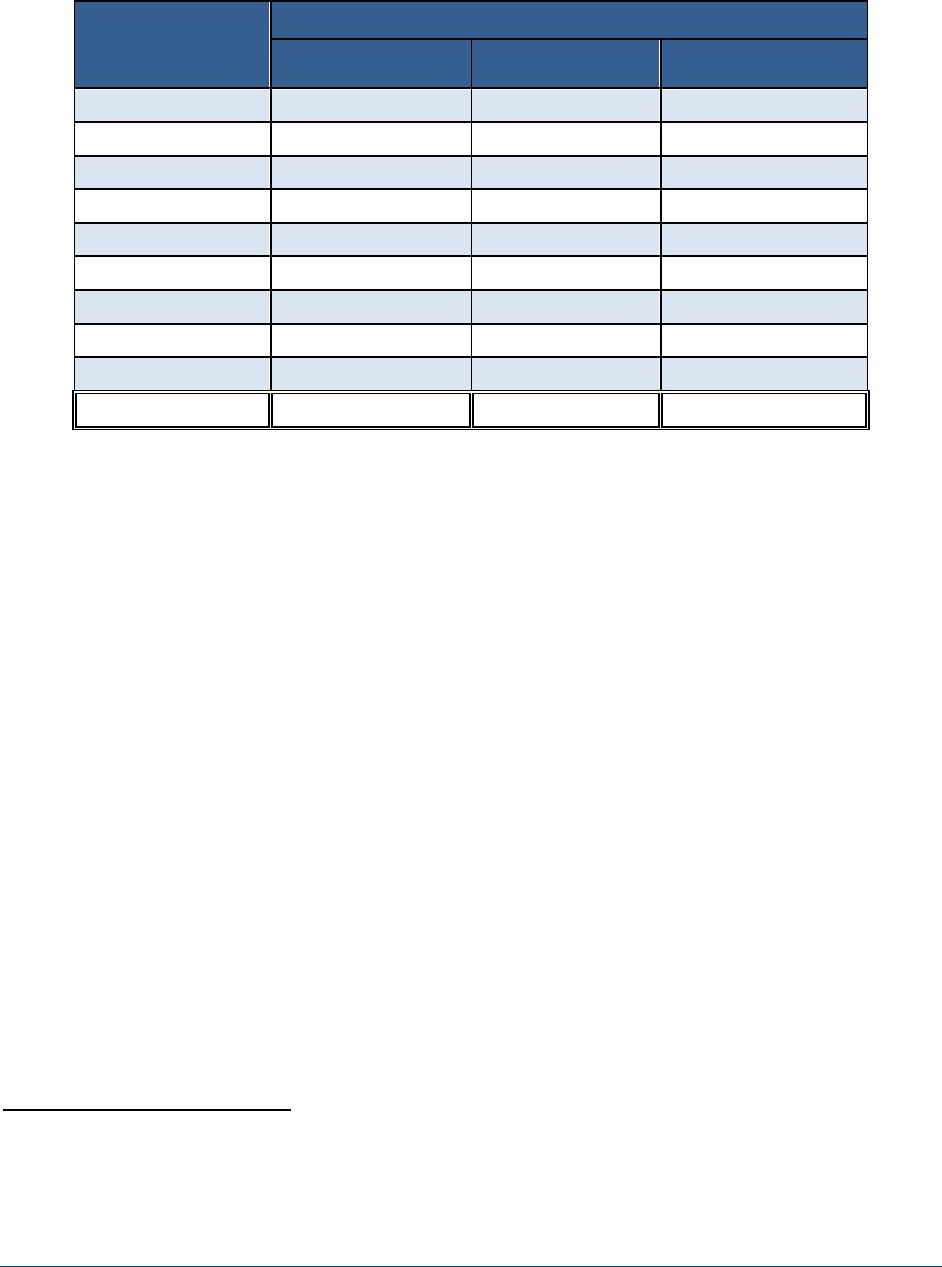

Table 1: The Volume of Social Security Statements Mailed

Fiscal Year

Number of Statements Mailed

Automatic

1

On-request

2

Total

2010

154,707,312

392,250

155,099,562

2011

74,427,249

268,060

74,695,309

2012

21,728,005

15,406

21,743,411

2013

-

7,608

7,608

2014

3,868,569

74,293

3,942,862

2015

49,577,044

515,026

50,092,070

2016

46,728,830

384,746

47,113,576

2017

13,285,401

115,617

13,401,018

2018

14,428,893

139,239

14,568,132

Total

378,751,303

1,912,245

380,663,548

Note 1: Mailed to individuals based on the Agency’s criteria.

Note 2: Mailed when individuals completed a Form SSA-7004-SM-OP1 or a similar form through SSA’s

Website.

FYs 2010 to 2013

In FY 2010, the Agency mailed about 155 million automatic Statements to individuals age 25

and older, not receiving Social Security benefits, and for whom SSA could determine mailing

addresses. This was the last year SSA mailed Statements in accordance with Section 1143 of the

Social Security Act. SSA suspended automatically mailing Statements in FY 2011 but mailed

about 75 million Statements to individuals during the first half of the FY. In March 2011, the

Commissioner of SSA notified Congress that, to conserve funds, the Agency was suspending

mailing Statements.

8

During that year, the Agency received about $1 billion less in funding than

it requested in the President’s budget. In FY 2012, citing budgetary issues, SSA continued

curtailing mailing automatic Statements, mailing about 22 million Statements. From February to

August 2012, the Agency mailed Statements to individuals age 60 and older, and, from July to

September 2012, it mailed Statements to individuals age 25 and older. In May 2012, SSA began

providing online access to Statements when it implemented my Social Security. SSA ceased

mailing automatic Statements in FY 2013, again citing budgetary issues.

8

Department of Labor, Health and Human Services, Education, and Related Agencies Appropriations for Fiscal

Year 2012: Hearing on Senate Bill S1599 Before the Subcommittee of the Committee on Appropriations, 112

th

Congress p. 11 (2011).

Issuance of Social Security Statements (A-03-18-50724) 5

FYs 2014 to 2018

In March 2014, SSA notified Congress that it would resume mailing automatic Statements to

individuals in September 2014.

9

SSA mailed about 3.9 million automatic Statements to

individuals who attained ages 25, 30, 35, 40, 45, 50, 55, and 60 by December 2014;

10

were not

receiving Social Security benefits; and did not have my Social Security accounts. According to

SSA, it stopped mailing Statements in accordance with section 1143 of the Social Security Act to

effectively use its resources to preserve the most critical commitments to public service. Further,

the Agency stated that mailing Statements to individuals using 5-year increments would ensure

everyone would receive an automatic Statement at least once every 5 years or more often if a

person requests one. In September 2014, the Agency notified the public about the change.

11

SSA did not mail Statements retroactively to those individuals who met the revised criteria

before September 2014. In FYs 2015 and 2016, SSA continued mailing automatic Statements to

individuals in 5-year increments, mailing approximately 49.6 million in FY 2015 and

46.7 million in FY 2016. Issuing Statements based on 5-year increments resulted in SSA

mailing about one-third of the Statements it mailed in FY 2010.

In the first quarter of FY 2017, SSA continued mailing Statements to individuals based on 5-year

increments, but, in January 2017, the Agency revised the criteria to mail automatic Statements to

individuals age 60 and older, not receiving Social Security benefits, and who do not have a

my Social Security account. SSA decided to mail automatic Statements to individuals for whom

the information was most essential, namely those who were near retirement. The change in

criteria resulted in SSA mailing automatic Statements to about 13 million individuals in

FY 2017. Again, the Agency indicated that budgetary considerations were the main reasons for

the reduction and believed it was complying with section 1143 of the Social Security Act because

it

considered the number of statements that would be mailed when constructing the budget,

made Statements available to anyone via my Social Security,

sent a reminder email to my Social Security account holders to check their online Statements,

mailed paper Statements to individuals who requested them, and

determined printing and mailing Statements to everyone required by the statute would

impede other essential work due to budgetary limitations.

9

SSA, Plan to Increase the Number of Individuals Annually Receiving Social Security Statements, Report to

Congress, p. 4 (March 2014).

10

SSA mailed the Statements 3 months before the individuals’ birthdays.

11

SSA, Agency Resumes Mailing Social Security Statements, ssa.gov (September 16, 2014).

Issuance of Social Security Statements (A-03-18-50724) 6

SSA first notified the public about the reduction in automatically mailing Statements in a

January 2017 blog post.

12

SSA continued mailing automatic Statements to individuals age 60

and older in FY 2018, which resulted in approximately 13.8 million Statements being mailed.

Issuance of Online Social Security Statements

The number of individuals who accessed their online Statements increased from about

1.9 million in FY 2012 to 16.8 million in FY 2018, see Table 2. The my Social Security portal

allows registered users to access their Statements any time at their own convenience.

Furthermore, making Statements accessible online benefits SSA because it reduces traffic to

field offices, calls to the Agency, and costs to print and mail automatic Statements.

When SSA implemented my Social Security in FY 2012, about 1.9 (96 percent) of the 2 million

registered users had accessed their online Statements. At that time, online Statements was the

only service offered via my Social Security, but additional services were added over time, such as

requesting replacement Social Security cards, changing addresses, and obtaining benefit

verification letters. In FY 2018, about 16.8 (43 percent) of the 38.8 million registered users

accessed their online Statements. Although the number of registered users who accessed their

Statements online had increased annually, the percent of registered users who accessed their

Statements had declined from 96 percent in FY 2012 to 43 percent in FY 2018. There could be

several contributing factors, such as individuals accessing other services via my Social Security.

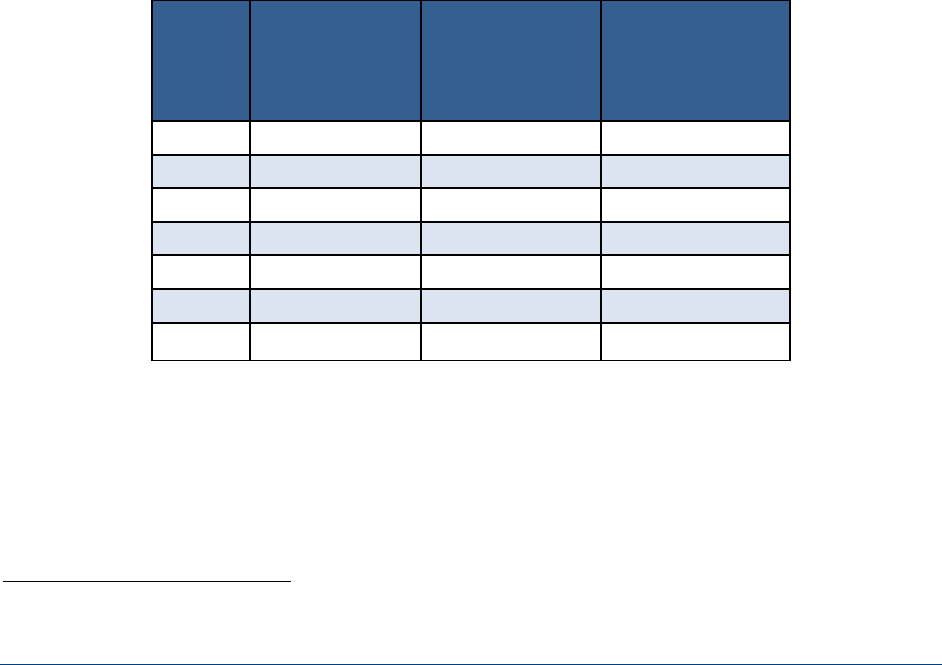

Table 2: Online Statements via my Social Security

FY

Total

Registered

Users

Users Who

Access Online

Statement

Percent of

Users Who

Access Online

Statement

2012

2,023,011

1,945,890

96

2013

8,352,201

7,135,204

85

2014

14,490,379

10,062,404

69

2015

21,139,321

12,776,556

60

2016

26,941,287

14,279,536

53

2017

32,655,922

15,654,742

48

2018

38,812,938 16,849,165 43

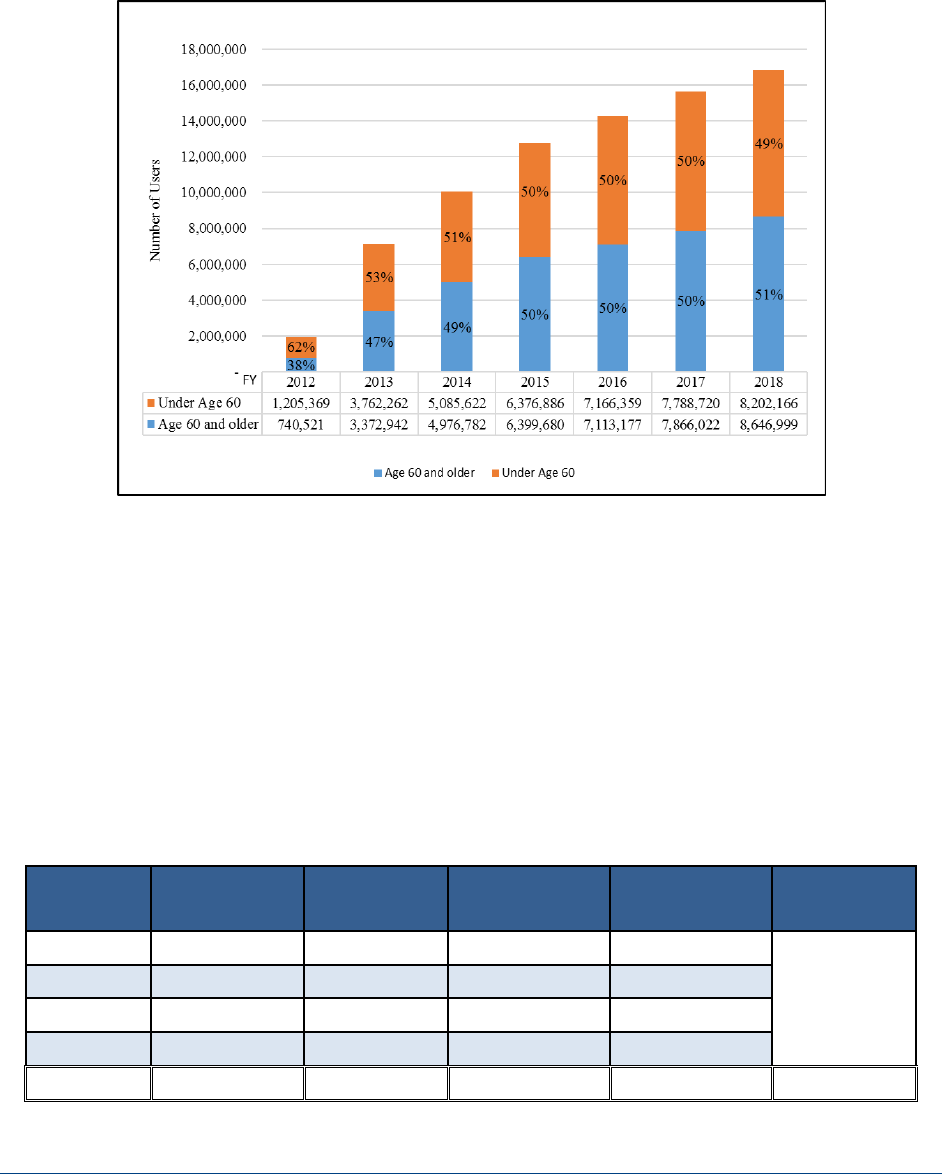

As shown in Figure 1, in FY 2012, 38 percent of the individuals who accessed their Statements

online were age 60 and older. This number increased to between 47 and 51 percent in FYs 2013

to 2018. This is the age group SSA targeted with mailing automatic Statements. Further,

stopping automatic Statement mailings to individuals under age 60 did not result in a significant

12

SSA, Finding Value—and my Social Security—in light of Budget Cuts, ssa.gov (January 9, 2017).

Issuance of Social Security Statements (A-03-18-50724) 7

increase in online Statement access for this group. During FYs 2013 to 2018, their level of

access remained relatively constant from 53 percent in FY 2013 to 49 percent in FY 2018.

Figure 1: Age Demographics of Registered Users Who Access Online Statements

Cost of Issuing Social Security Statements

As shown in Table 3, in FYs 2010 to 2013, SSA spent about $107 million to print and mail

automatic and on-request Statements to approximately 252 million individuals. Specifically,

about $12.9 million related to printing, and $94.3 million related to postage. It cost SSA, on

average, $0.43 to print and mail one Statement during this period. In FY 2010, the last time SSA

mailed Statements in accordance with section 1143 of the Social Security Act, it cost about

$65 million to print and mail approximately 155 million Statements. The cost decreased in

FYs 2011 to 2013, when SSA suspended mailing the automatic Statements, from about

$32 million to $3,500, respectively.

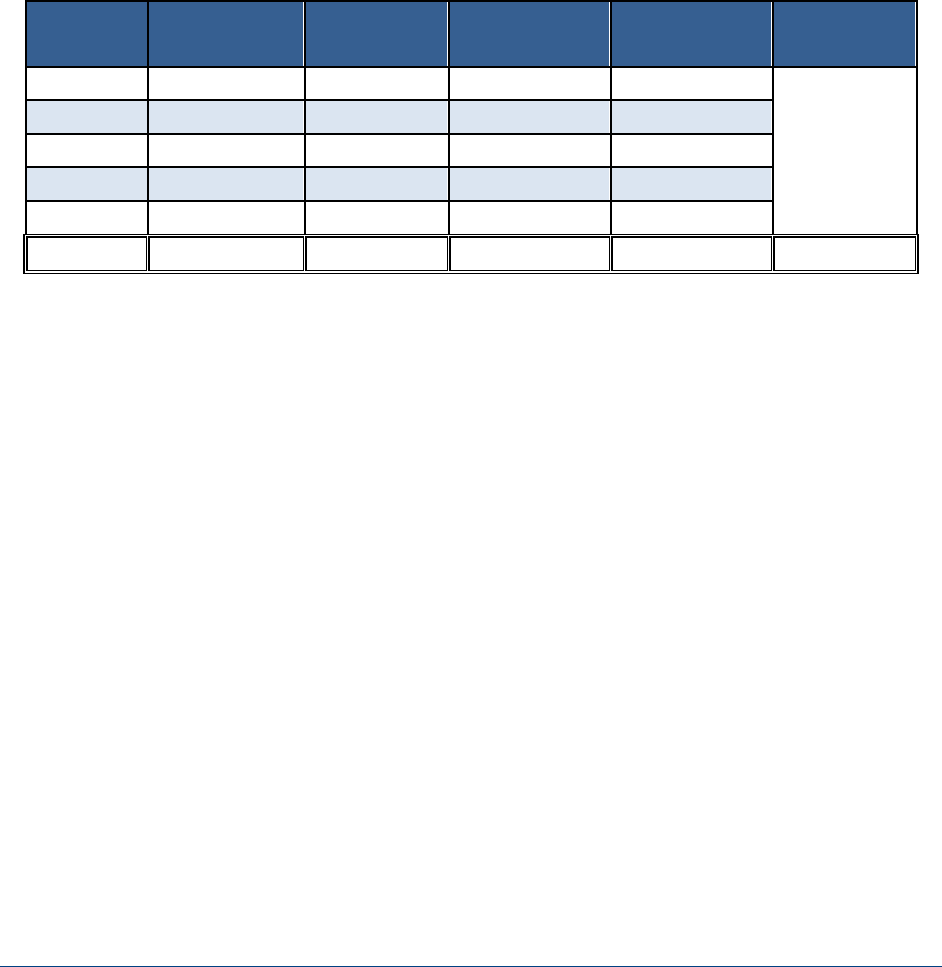

Table 3: Costs of Social Security Statements FYs 2010 to 2013

FY Volume Printing Postage Total

Cost Per

Statement

2010

155,099,562

$7,057,223

$57,541,938

$64,599,161

2011

74,695,309

$4,227,479

$28,309,522

$32,537,001

2012

21,743,411

$1,565,761

$8,458,187

$10,023,948

2013

7,608

$289

$3,196

$3,485

Total

251,545,890

$12,850,752

$94,312,843

$107,163,595

$0.43

Issuance of Social Security Statements (A-03-18-50724) 8

In FYs 2014 to 2018, the cost of mailing Statements decreased significantly because the Agency

changed its criteria for mailing automatic Statements and online Statements were available.

During the 5-year period, SSA spent about $66.7 million to print and mail approximately

129 million Statements to individuals, see Table 4. About $11.2 million related to printing and

$55.5 million related to postage. It cost SSA, on average, $.52 to print and mail one Statement

during this period. The annual costs ranged from about $2 million in FY 2014, the year SSA

resumed mailing automatic Statements, to approximately $26 million in FY 2015, when SSA

mailed automatic Statements to individuals in 5-year increments. In FY 2018, the year SSA

mailed automatic Statements to individuals age 60 and older who were not registered for

my Social Security, the costs decreased to about $7.6 million.

Table 4: Costs of Social Security Statements FYs 2014 to 2018

FY Volume Printing Postage Total

Cost Per

Statement

2014

3,942,862

$332,124

$1,715,733

$2,047,857

2015

50,092,070

$4,206,031

$21,865,166

$26,071,197

2016

47,113,576

3,989,118

20,033,608

$24,022,726

2017

13,401,018

$1,280,333

$5,670,538

$6,950,871

2018

14,568,132

$1,408,446

$6,172,971

$7,581,417

Total

129,117,658

$11,216,052

$55,458,016

$66,674,068

$0.52

Printing Contract for Social Security Statements

SSA’s printing contract commenced on September 1, 2014 for an initial period ended

August 31, 2015 plus up to four optional 12-month extension periods. The Agency exercised all

option years bringing the contract end date to August 31, 2019. SSA worked with the

Government Publishing Office to procure a “requirements” contract that allows SSA to adjust

the volume of Statements it would produce according to its needs. The requirements clause of

the contract stated that “The quantities of items specified herein are estimates only, and are not

purchased hereby.” Further, it stated, “Except as may be otherwise provided in this contract, if

the Government’s requirements for the items set forth herein do not result in orders in the

amounts or quantities described as ‘estimated,’ it shall not constitute the basis for an equitable

price adjustment under this contract.”

The contract showed an estimated 45 million Statements would be ordered, annually, but

allowed SSA to increase or decrease by up to 25 percent of the total number of Statements

ordered each year. Regarding the variation between estimated volumes, the Agency stated the

contract specifications were developed to ensure SSA would not need to re-solicit a new contract

if it added other age groups to the Statements production, a process that could take

approximately 9 to 12 months to complete. As of January 2019, SSA staff indicated it was

working with the Government Publishing Office to solicit the new contract for printing and

mailing Statements.

Issuance of Social Security Statements (A-03-18-50724) 9

CONCLUSIONS

In FYs 2010 to 2018, SSA mailed approximately 381 million paper Statements to individuals to

inform them about their lifetime earnings and future Social Security benefits. Section 1143 of

the Social Security Act requires that SSA send automatic Statements to individuals age 25 and

older who are not receiving Social Security benefits. However, over the years, SSA has

modified the age groups to whom it sends Statements. In FYs 2014 to 2018, the Agency mailed

workers about 129 million paper Statements. Between FYs 2014 and 2016, SSA mailed

automatic Statements to individuals who attained ages 25, 30, 35, 40, 45, 50, 55, and 60 and

older; were not receiving Social Security benefits; and did not have my Social Security accounts.

In FYs 2017 and 2018, SSA decided to send Statements to individuals age 60 and older for

whom the information was most essential as they were close to retirement.

Moreover, the costs for mailing the paper Statements decreased from FYs 2010 to 2018 because

SSA changed the age groups to whom the Agency mailed Statements. In FY 2010, the Agency

spent about $65 million to print and mail approximately 155 million Statements, and, in

FY 2018, it spent about $7.6 million to print and mail approximately 14.6 million Statements.

Finally, the contract awarded to mail paper Statements allowed SSA to adjust the number of

Statements mailed annually. The contract showed that SSA would order an estimated 45 million

Statements annually but allowed the Agency to increase or decrease the order by up to 25 percent

to allow flexibility in case SSA decided to modify the age groups to whom it would mail

Statements and to avoid re-soliciting the contract.

AGENCY COMMENTS

SSA had no comments on the report; see Appendix D.

Rona Lawson

Assistant Inspector General for Audit

Issuance of Social Security Statements (A-03-18-50724)

APPENDICES

Issuance of Social Security Statements (A-03-18-50724) A-1

– EXAMPLE SOCIAL SECURITY STATEMENT

Issuance of Social Security Statements (A-03-18-50724) A-2

Issuance of Social Security Statements (A-03-18-50724) A-3

Issuance of Social Security Statements (A-03-18-50724) A-4

Issuance of Social Security Statements (A-03-18-50724) A-5

Issuance of Social Security Statements (A-03-18-50724) B-1

– CONGRESSIONAL REQUEST LETTER

Issuance of Social Security Statements (A-03-18-50724) B-2

Issuance of Social Security Statements (A-03-18-50724) C-1

– SCOPE AND METHODOLOGY

To achieve our objective, we:

Reviewed applicable sections of the Social Security Act and Social Security Administration’s

(SSA) regulations.

Reviewed Public Laws applicable to Social Security Statement (Statement) issuance.

Reviewed applicable sections of SSA’s Program Operations Manual System.

Reviewed prior Office of the Inspector General and Government Accountability Office

reports related to Statements.

Obtained and reviewed management information related the number of Statements mailed,

associated costs of mailing Statements, and printing contracts for Statements.

Reviewed SSA’s Presidential Budget requests and Full Justification of Estimates for

Appropriations, Fiscal Years 2010 to 2018.

Obtained and reviewed demographical information related my Social Security enrollment and

online Statement usage.

Obtained and reviewed publications and media coverage related to Statement mailings and

the availability of the online Statements via my Social Security.

We conducted our review between June and December 2018 in Philadelphia, Pennsylvania. SSA

staff provided all data for this request. Based on our research and analysis, we believe these data

were sufficiently reliable to meet our audit objective. The principal entity reviewed was SSA’s

Office of Systems. We conducted this audit in accordance with generally accepted government

auditing standards. Those standards require that we plan and perform the audit to obtain

sufficient, appropriate evidence to provide a reasonable basis for findings and conclusions based

on our audit objectives. We believe that the evidence obtained provides a reasonable basis for

our findings and conclusions based on our audit objectives.

Issuance of Social Security Statements (A-03-18-50724) D-1

– AGENCY COMMENTS

SOCIAL SECURITY

MEMORANDUM

Date:

February 11, 2019 Refer To: S1J-3

To:

Rona Lawson

Assistant Inspector General for Audit

From:

Stephanie Hall

Acting Deputy Chief of Staff

Subject:

Office of the Inspector General Draft Congressional Response Report, “Issuance of Social

Security Statements” (A-03-18-50724) -- INFORMATION

Thank you for the opportunity to review the draft report regarding our issuance of Social

Security Statements. We have no comments.

Please let me know if we can be of further assistance. You may direct staff inquiries to

Trae Sommer at (410) 965-9102.

MISSION

By conducting independent and objective audits, evaluations, and investigations, the Office of

the Inspector General (OIG) inspires public confidence in the integrity and security of the Social

Security Administration’s (SSA) programs and operations and protects them against fraud,

waste, and abuse. We provide timely, useful, and reliable information and advice to

Administration officials, Congress, and the public.

CONNECT WITH US

The OIG Website (https://oig.ssa.gov/) gives you access to a wealth of information about OIG.

On our Website, you can report fraud as well as find the following.

• OIG news

• audit reports

• investigative summaries

• Semiannual Reports to Congress

• fraud advisories

• press releases

• congressional testimony

• an interactive blog, “

Beyond The

Numbers” where we welcome your

comments

In addition, we provide these avenues of

communication through our social media

channels.

Watch us on YouTube

Like us on Facebook

Follow us on Twitter

Subscribe to our RSS feeds or email updates

OBTAIN COPIES OF AUDIT REPORTS

To obtain copies of our reports, visit our Website at https://oig.ssa.gov/audits-and-

investigations/audit-reports/all. For notification of newly released reports, sign up for e-updates

at https://oig.ssa.gov/e-updates.

REPORT FRAUD, WASTE, AND ABUSE

To report fraud, waste, and abuse, contact the Office of the Inspector General via

Website: https://oig.ssa.gov/report-fraud-waste-or-abuse

Mail: Social Security Fraud Hotline

P.O. Box 17785

Baltimore, Maryland 21235

FAX: 410-597-0118

Telephone: 1-800-269-0271 from 10:00 a.m. to 4:00 p.m. Eastern Standard Time

TTY: 1-866-501-2101 for the deaf or hard of hearing